U.S. job growth likely rebounded in January as authorities began easing COVID-19 restrictions on businesses with the ebbing pace of infections, which could offer the strongest signal yet that the worst of the labor market turmoil was behind after the economy shed jobs in December. The Labor Department’s closely watched employment report on Friday will, however, not lessen the need for additional relief money from the government, with millions of people experiencing long bouts of unemployment and others having permanently lost their jobs, and given up the search for work.

The economy would still be about 10 million jobs short from the labor market’s peak in February 2020. President Joe Biden is pushing the U.S. Congress to pass a $1.9 trillion recovery plan, which has been met with resistance from mostly Republican lawmakers, now worried about the swelling national debt. Biden’s fellow Democrats in the Senate were on Thursday set to take a first step toward the ultimate passage of the proposed stimulus package.

The survey of establishments is likely to show that nonfarm payrolls increased by 50,000 jobs last month after declining by 140,000 in December, according to a Reuters survey of economists. December’s drop was the first in eight months and came amid renewed restrictions on businesses like restaurant and bars to slow a resurgence in coronavirus infections.

The pace of COVID-19 infections appears to have peaked in early January, a trend that could also give a lift to hiring in the months ahead, should it hold. Infections hit a one-day record of roughly 300,000 in early January but by month’s end were averaging closer to 100,000 a day, with most of the country seeing a downward trend, according to a Reuters tally.

The economy has recouped 12.5 million of the 22.2 million jobs lost in March and April. The Congressional Budget Office estimated on Monday that employment would not return to its pre-pandemic level before 2024.

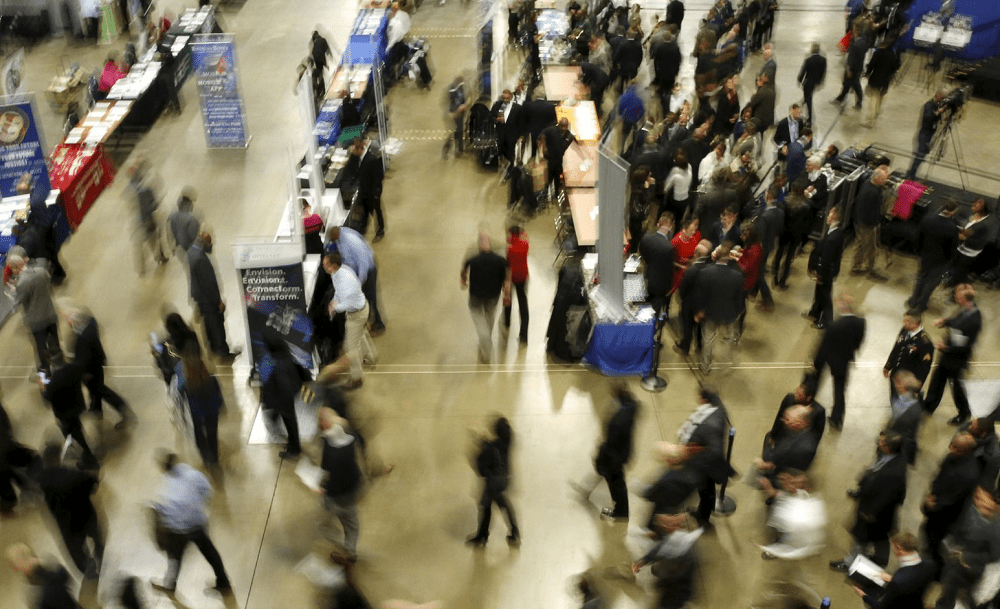

U.S. employment growth likely rebounded; more government money still needed, Reuters, Feb 5