Residential property prices in the U.K. fell by the most since the global financial crisis from April through June, according to mortgage provider Halifax. Values declined 0.9% compared with the first three months of the year as the country locked down due to the coronavirus pandemic. However, on a yearly basis, prices rose across Wales and all regions of England. Scotland bucked this trend with a 0.8% slide, its first decline in seven years.

On Wednesday, the government temporarily lifted a sales tax levied against the first 500,000 pounds ($630,000) of house prices. The move is aimed at reviving activity in the market, although analysts have questioned how effective it will be.

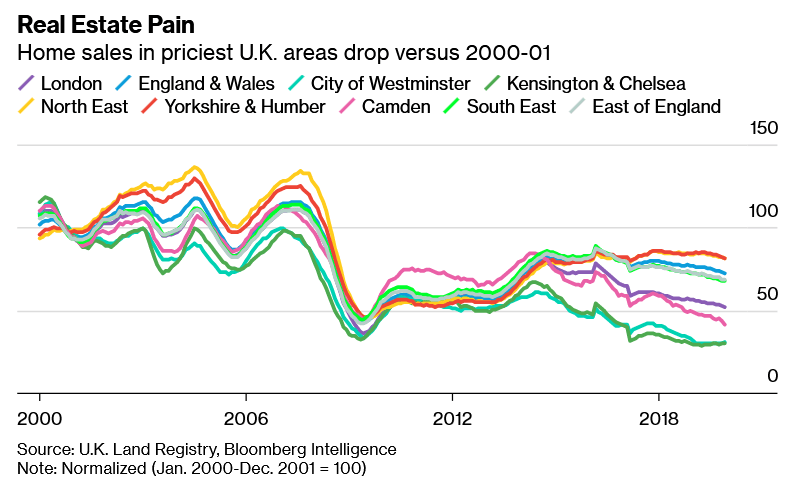

The stamp duty break, which came into effect immediately and remains until March 2021, could provide a much-needed boost to the market for expensive homes in London and southeast England. Those two regions have traditionally had the highest house prices in the country. The house price-to-earnings ratio remains at historically high levels at 6.18%, against 6.20% for the first quarter of 2020.

U.K. House Prices Drop Most Since Financial Crisis in Lockdown, Bloomberg, Jul 10