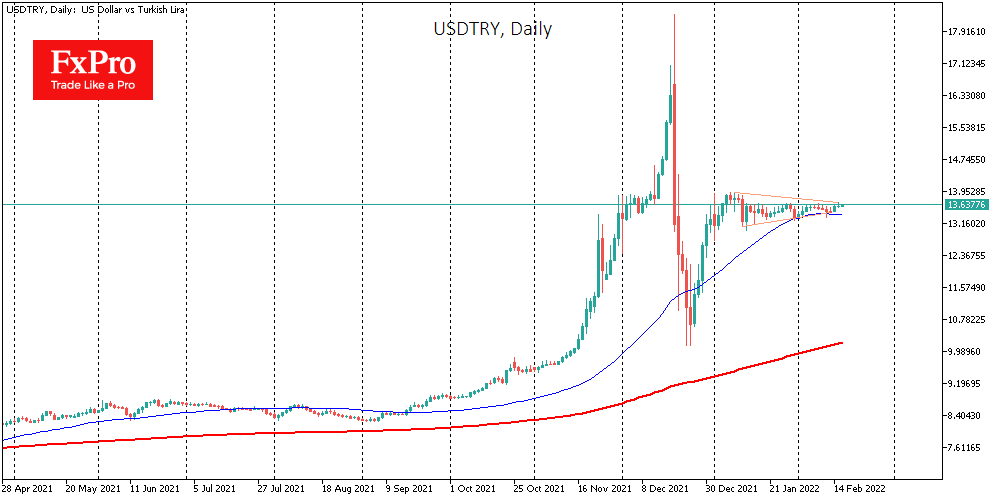

The Turkish lira has stabilised after the wild ride of December. Since the start of the year, the fluctuation of the lira formed a converging range with a centre of gravity at 13.50 in USDTRY and 15.40 in EURTRY.

However, this lull is hardly a victory for the unorthodox monetary policy ideas being pursued by Turkey. Instead, market participants have turned their attention to developments in Russia and Ukraine, which has made Turkey, if not a haven, comparatively less dangerous for investors.

Nevertheless, we see this lull as temporary, expecting the rate to move out of consolidation upwards, as Turkey’s fight against inflation is weaker than necessary. Excessive monetary policy softness is further highlighted by monetary tightening worldwide, including in Europe, where central banks are moving to raise rates or roll back stimulus.

The latest inflation estimates for January show consumer prices adding 50% and manufacturing prices almost doubling from the same month a year earlier. PPI is being pushed up by 70% devaluation of the national currency, plus a general rise in producer prices close to 10% in countries from China to the USA.

Consumer prices have not yet fully absorbed the effects of the fall devaluation of the lira and promise to gain momentum in the coming months, continuing to undermine confidence in the national currency.

An assessment of how inadequately soft Turkey’s monetary policy is can be made by comparing the differential of inflation and the key rate. In Turkey, it is 35%, in Russia minus 1%, in Ukraine around 0% and in the UK 5%. Even in the US, where it is believed that the Fed has overlooked inflation and will now have to catch up with it through 7 0.25 point hikes this year, this differential is 7.25%, almost five times less than in Turkey.

From all of this, there is a conclusion that the Turkish lira is heading upwards out of the consolidation range, i.e., a new round of currency decline is to be expected. However, this wave will likely not be as disastrous as it was in the final quarter of last year.

The FxPro Analyst Team