Donald Trump and his wife Melania test positive for coronavirus, which puts pressure on world markets. The president’s commitment to quarantine immediately is likely to force him to reconsider his campaign plans. Potentially, this news will reduce his chances of improving his rating in the coming month.

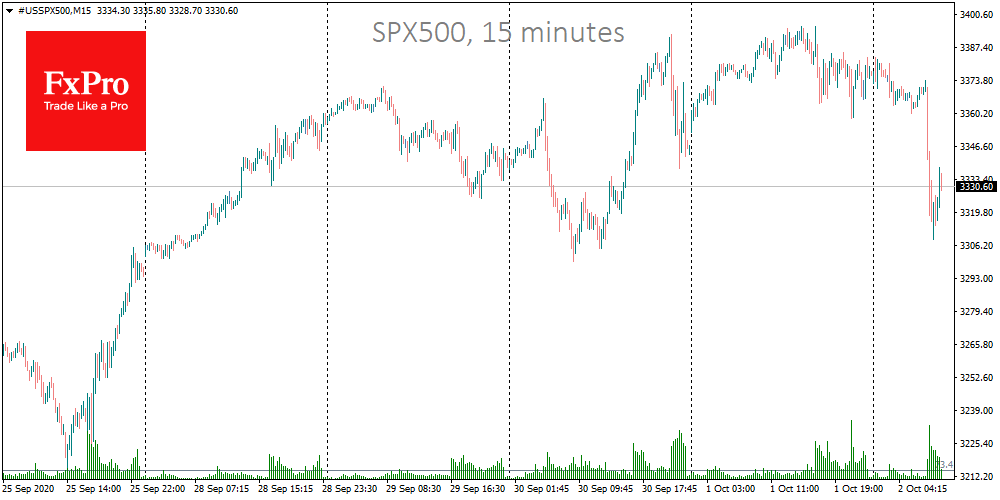

Losses on the S&P 500 futures have reached 2% since the start of the day, having stabilised near intraday lows of September 30th.

For markets, a fall in Trump’s chances of winning is bad news as Biden’s arrival promises higher taxes and more focus on supporting the lower-income households. It is generally believed that this will increase the burden on businesses.

This is no more than a short-term impulse for markets because it is difficult to find statistical support that markets are weaker under Democrats than under Republicans. Therefore, it is still too early to take a bearish position for the coming years.

As the markets in Europe and the USA open throughout the day, it is worth being prepared for periodic bursts of volatility in both directions. In addition to Trump’s illness, we should look at the discussion and further action of the relief package along with US legislative corridors and jobs data for September.

In this context, it will be interesting to monitor the reaction of the foreign exchange market and gold. If the decline in the US indices does not translate into the total elimination of risk positions and margin-calls, we can very well expect more pressure on the US currency.

The dollar risks losing some of its attractiveness, as, without the promise of tax breaks, other markets may seem more appealing to investors than before. Gold may return to its protective role in times of heightened uncertainty.

However, it is important to understand that such gloomy forecasts for the dollar only work if the markets are functioning well. If the situation slides more and more into chaos, as was at the beginning of March, margin-calls and deleveraging could quickly lead to the dollar sweeping away everything that lies in its path.

The FxPro Analyst Team