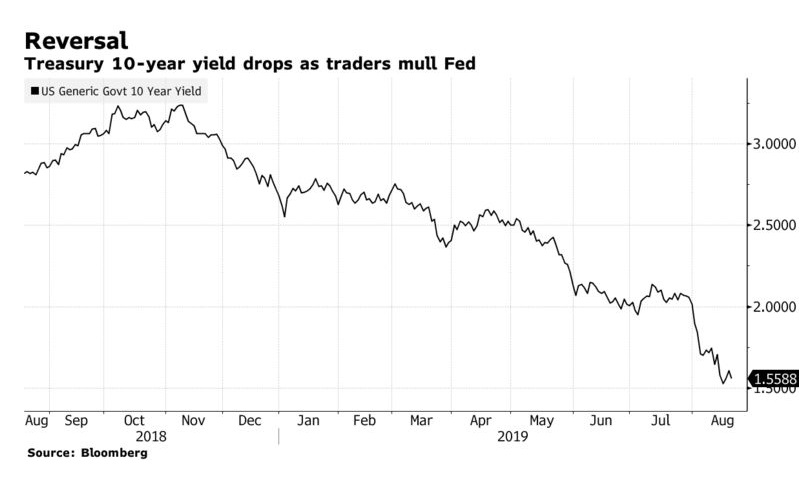

Treasuries climbed as investors assessed the latest developments on U.S.-China trade negotiations and awaited more clues on monetary policy. Stocks retreated. Benchmark 10-year yields extended their slide after U.S. Secretary of State Michael Pompeo told CNBC that Huawei Technologies Co. isn’t the only Chinese company that poses risks. He also sees the U.S. and China continuing their talks — at least by phone — over the next week or 10 days. The S&P 500 Index halted a three day rally as traders digested earnings from retailers Home Depot Inc. and Kohl’s Corp. The dollar traded near this year’s high.

President Trump’s top economic adviser, Larry Kudlow, will speak with business leaders this week amid concerns about the rising odds for a recession, the trade war and whipsawing markets. That comes before Powell’s remarks about the challenges for monetary policy at the Jackson Hole symposium Friday.

The S&P 500 fell 0.4% to 2,912.56 at 9:33 a.m. in New York. The Stoxx Europe 600 Index fell 0.3%. The MSCI Asia Pacific Index climbed 0.6%. The Bloomberg Dollar Spot Index declined 0.1%. The euro was little changed at $1.1079. The Japanese yen increased 0.3% to 106.29 per dollar. The yield on 10-year Treasuries decreased five basis points to 1.55%. Germany’s 10-year yield dipped six basis points to -0.70%. Britain’s 10-year yield fell four basis points to 0.43%.