After pausing at the last meeting, the Fed will announce its rate decision today with a widely expected 25-point hike to a range of 5.25%-5.50%. This event is 97% priced into interest rate futures, according to the FedWatch tool, and the main intrigue lies in the clues as to the Fed’s next moves. And there is plenty of room for speculation.

In their speeches, FOMC officials keep reminding us that the fight against inflation is not over and will be a long one. Translated into the language of interest rates, this means the prospect of (at least) one more hike and a long (up to a year) plateau period.

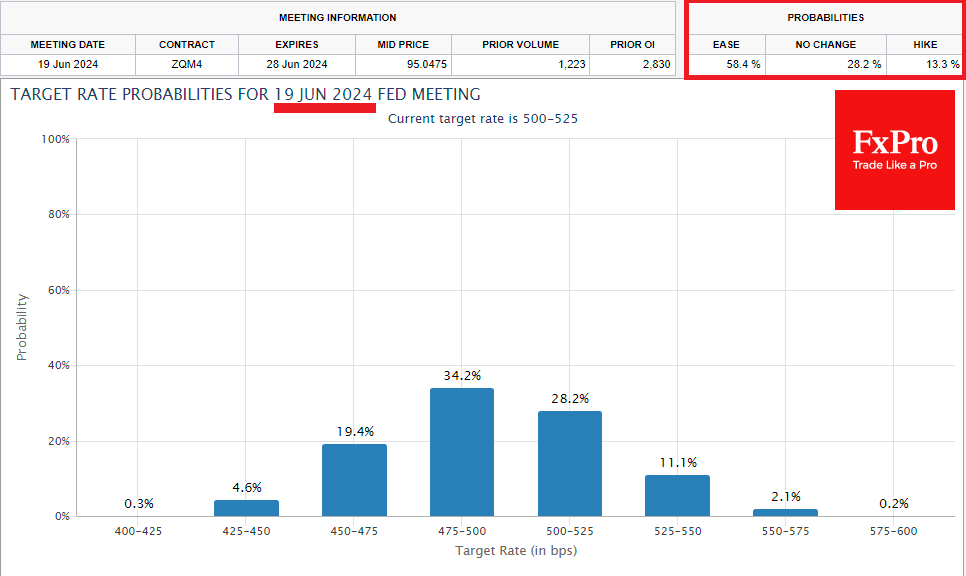

Markets see the situation differently, assuming there will be no further hikes and that the first cut will come before a year.

Managing these expectations is a major challenge for the Fed. But does the US central bank have to? If so, it could disappoint markets and give the dollar a boost.

In addition to core and headline inflation, the Fed also looks at the labour market. The near multi-year low in the unemployment rate promises to keep upward pressure on prices, suggesting room for further tightening. Separately, house prices are rising for the third month in a row, despite multi-year highs in mortgage rates. Rental prices are rising even faster, reducing the backlog from previous years but acting as a critical pro-inflationary factor.

The Fed’s hawkish tone later on Wednesday could trigger a broad correction in equities and provide a longer-term boost to the dollar, taking the DXY index into the 103.0-103.7 range. This could lead to widespread profit-taking in equities, taking the Nasdaq100 below 15000 and the S&P500 to 4400.

A softening of the Fed’s stance would pave the way for a quick return of the DXY below 100 and set the stage for further gains in equities, with the potential to update multi-month highs in the coming weeks.

The FxPro Analyst Team