- The dollar is under pressure due to threats to the Fed’s independence.

- The yen has weakened due to the government’s political adventurism.

What is happening now is reminiscent of the hysteria that followed America’s Liberation Day. Take a deep breath, exhale, and let events unfold. This is how Scott Bessent tried to calm the financial markets and the US’s European partners. He urged them not to retaliate. However, another parallel with the events of April accelerated the sell-off of everything American. Stocks, bonds and the dollar all collapsed. Admittedly, to a lesser extent compared to the announcement of global tariffs back then.

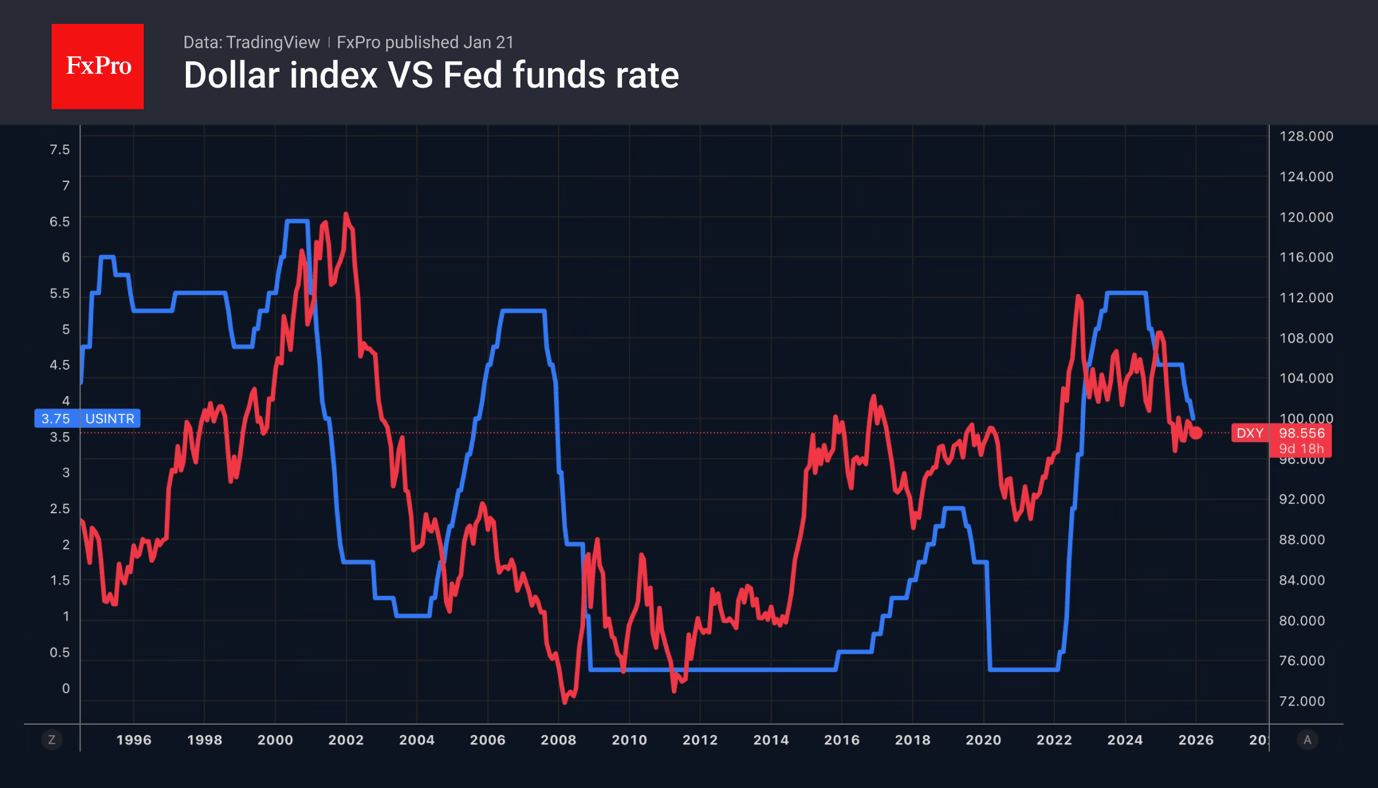

Pressure on the greenback was created by criticism of the Fed chairman from the Treasury and the Lisa Cook hearing. The court will decide whether the protection of the central bank from political interference, created by Congress 90 years ago, will stand or not. If Donald Trump is able to dismiss and appoint FOMC members at will, the federal funds rate will fall to 1%, and with it, the US dollar will collapse.

Jerome Powell’s intention to attend the Lisa Cook trial outraged Scott Bessent. He accused the Fed chairman of causing huge losses to the central bank due to large-scale monetary stimulus during the pandemic. Everything is bad for the executive branch: both when the Fed keeps rates unchanged and when it lowers them.

The noise and dust surrounding White House politics is causing investors to flee the dollar and other American assets. The surge in Treasury bond yields is the result of a ‘sell America’ attitude. Events in Japan are adding fuel to the fire in global debt markets. There, long-term bond yields have reached record levels on fears that early elections to the lower house of parliament are a political gamble by Sanae Takaichi.

The Liberal Democratic Party’s long-time ally, Komeito, has joined the opposition, and the policy of fiscal stimulus and low interest rates risks fuelling inflation. The associated decline in real household income will lead to discontent with the current government. As a result, the yen feels out of place even against the backdrop of a frankly weak US dollar. USDJPY cannot decide on the direction of further movement and is stuck in indecision.

Gold is another matter. Its new record high is due, among other things, to the Supreme Court’s reluctance to rule on the legality of US tariffs. This could drag on until June.

The FxPro Analyst Team