The US dollar rose on Tuesday, adding 0.65% against a basket of popular world currencies amid Donald Trump’s statements about his desire to increase the universal tariff on all imported goods above the current 2.5%.

News of the tariffs supports the US dollar as it suggests a reduction in the US trade deficit and an increase in demand for local goods. Currently, this represents a market reaction to plans that have yet to be implemented, but the information has supported the dollar from a technical analysis perspective.

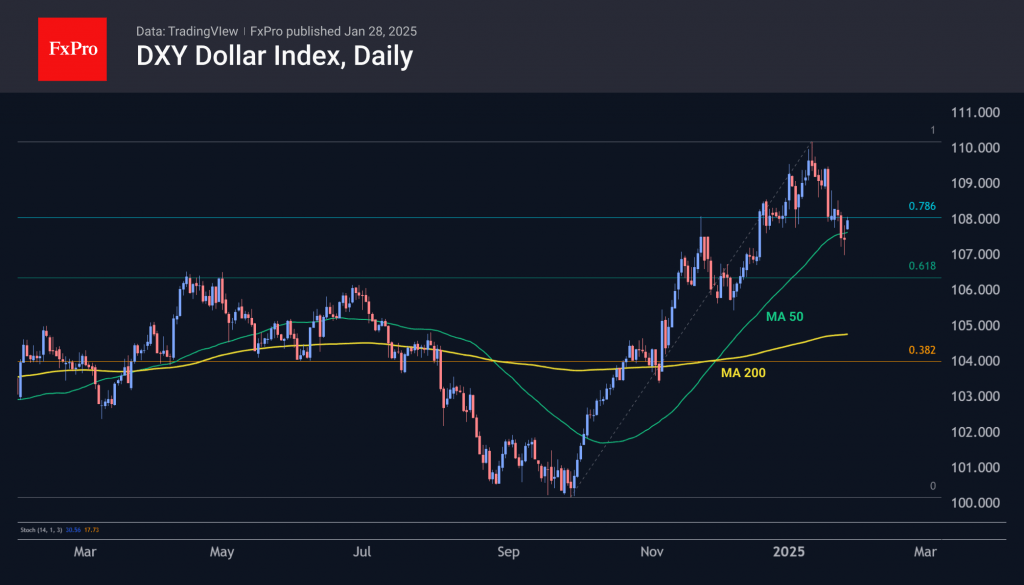

Last week, the DXY index finished below its 50-day moving average, breaking a four-month uptrend. However, a quick return above that level this week allows the decline on Friday to be viewed as a temporary deviation.

With further growth of the dollar, the decline of the previous two weeks can be interpreted as corrective, which allowed to fix profits and clear the way for further growth with the renewal of the January highs. The Fibonacci extension points to a potential target for the DXY index around 116, which corresponds to a rise to 161.8% of the initial momentum. But in practice, the path may be less straightforward.

Later this week, the Fed meets, where no change in the key rate is expected. The focus will be on plans for 2025 and whether expectations of two rate cuts are confirmed.

Tariff threats may encourage the Fed to stick to tighter monetary policy, but this is at odds with Donald Trump’s recent demands for rate cuts to stimulate growth. In the currency market, low rates help weaken the dollar, offsetting the effect of higher tariffs, with the economy receiving an additional boost to inflation. This raises the question of the Fed’s tolerance for inflation. Both in Trump’s first term and immediately after the last election, the Fed tightened its rhetoric at the prospect of the effects from tariffs.

Higher inflation at healthy growth rates could help the US reduce its government debt-to-GDP ratio by depreciating the dollar’s real purchasing power. However, this is a complex process that requires a high level of international coordination. The United States succeeded in the 1980s with the Plaza Accord, but the question remains whether it can do so again.

The FxPro Analyst Team