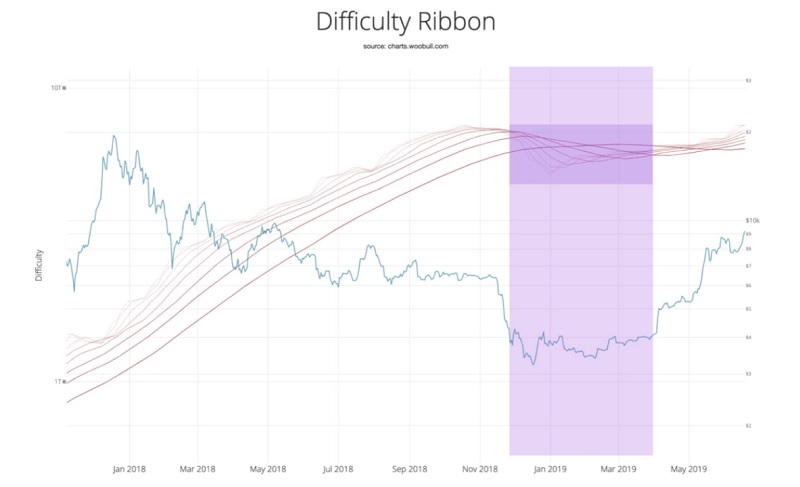

It’s easy to get scared away by the daily volatile movements of bitcoin. Over the weekend, bitcoin jumped 20 percent in a matter of days. Since then, BTC shed over $1,000 before recovering slightly again. It’s a volatile market. But zoom out for a moment and you’ll see the bigger picture. This chart, shared by on-chain analyst Willy Woo, pinpoints the best windows of opportunity to buy bitcoin for the long term.

Using what’s called the ‘ribbon difficulty’ indicator laid across the long-term logarithmic bitcoin chart, it has historically predicted the best moments to get exposure to bitcoin over the last ten years. So next time you’re about to FOMO into the market, zoom out and take note of this chart.

According to Willy Woo’s analysis, the perfect moment to accumulate bitcoin is when the difficulty ribbon compresses (gets very thin) or flips negative (when the strong, dark line crosses above the weaker lines), shown below. The indicator accurately predicted the bottom of the market in late 2018, early 2019. Smart investors should have started accumulating at this point (many hedge funds were). It’s a data-driven confirmation of a decades-old investment strategy: buy when there’s blood in the streets. In other words, you buy assets when others are fearful, and sell when they’re greedy.