Since the end of last week, the Yen has regained ground against the Dollar and the Euro in what looks like a new round of appreciation. So far, this seems to be an independent theme for the Yen’s rise, without any deterioration in sentiment in the equity and bond markets.

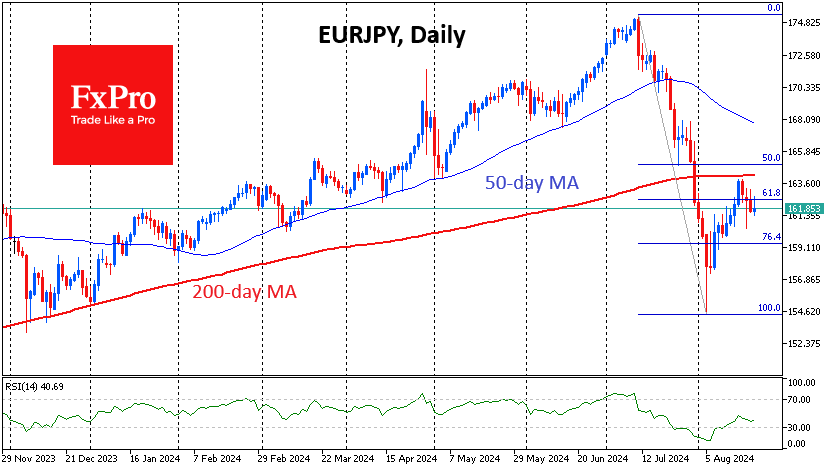

EURJPY plunged from a peak above 175 to 155 in just 17 trading days to the 5th of August, breaking the 50- and 200-day moving averages in powerful moves on the way down. The subsequent rebound lost strength as it approached the 200-day moving average and the 61.8% Fibonacci retracement level from the initial collapse.

The USDJPY rebound was even less pronounced, failing to reach even the 61.8% level near 149.50 from the 162 to 142 drops.

A little over two weeks ago, the rise of the Yen was halted without the help of the Bank of Japan, whose officials said they would not raise interest rates during the volatile period. The rebound in equity indices and the sharp drop in volatility are reviving speculation about a rate hike in Japan, which contrasts with the high confidence in the ECB and the Fed easing as early as next month.

We would not be surprised to see the euro and the dollar return to local lows against the Yen of 155 and 142, respectively.

The FxPro Analyst Team