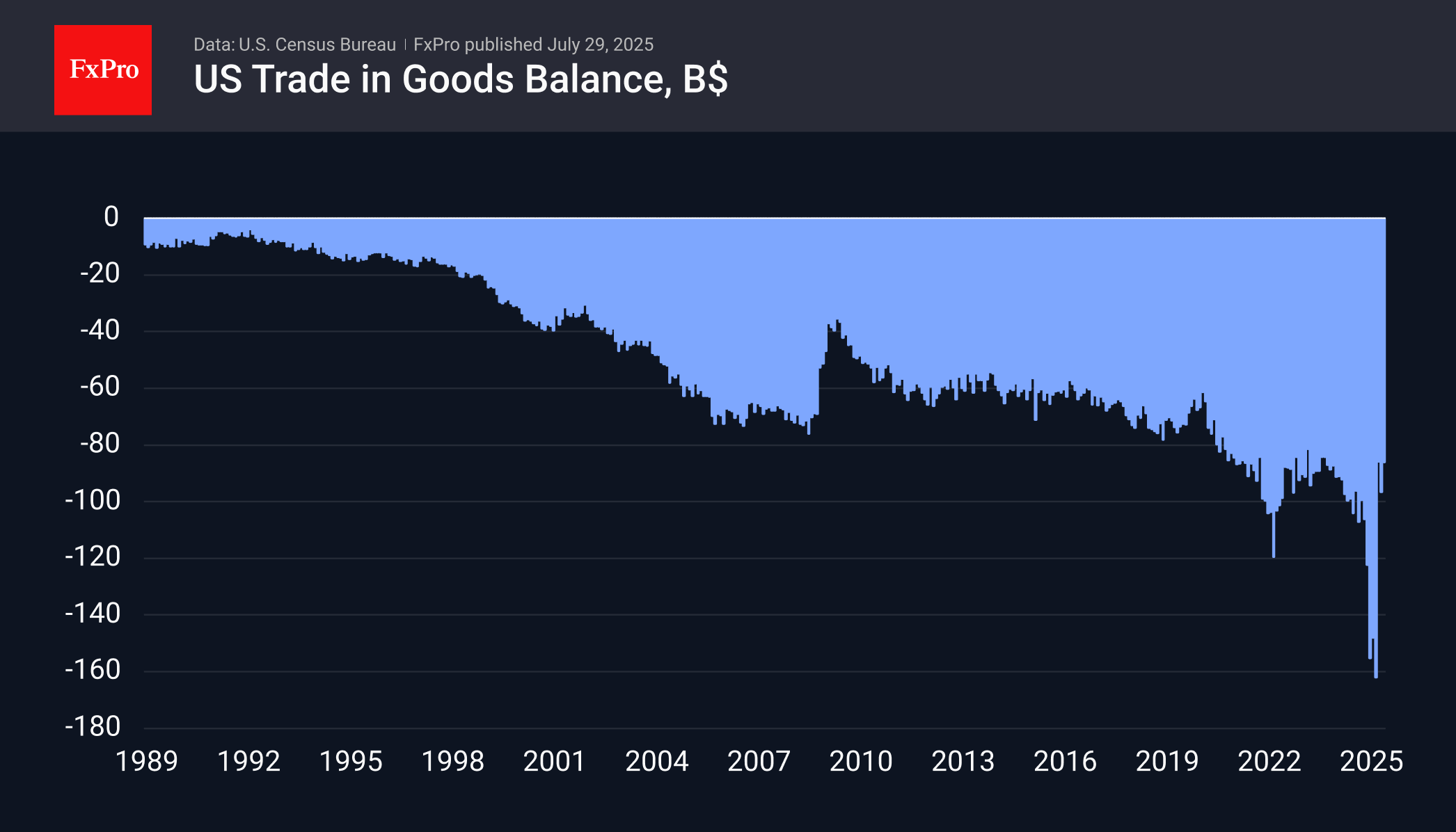

Due to a decline in imports, the US trade deficit narrowed in June to $86 billion, down from $96.4 billion a month earlier and a peak of $162 billion in March. Anticipating trade disputes, US importers began to increase purchases sharply in December. However, even without this, the deficit hovered near a record $100 billion per month throughout the second half of 2024.

Now, imports are returning after their surge, but their June volume of $264 billion is the lowest since March last year, and it is still too early to talk about a reversal of the long-term growth trend. Exports continue to show a long-term trend of gradual growth, although they lost 0.6% last month.

Moving from macroeconomics to FX, it is worth noting that the inflation of the commodity deficit since the end of last year could have been an important fundamental factor in the weakening of the dollar. Now, however, its impact is becoming neutral or positive for the dollar. If demand from the US continues to decline sharply, reducing the trade deficit, as was the case in 2020 or 2008, this could play into the hands of the US currency.

The FxPro Analyst Team