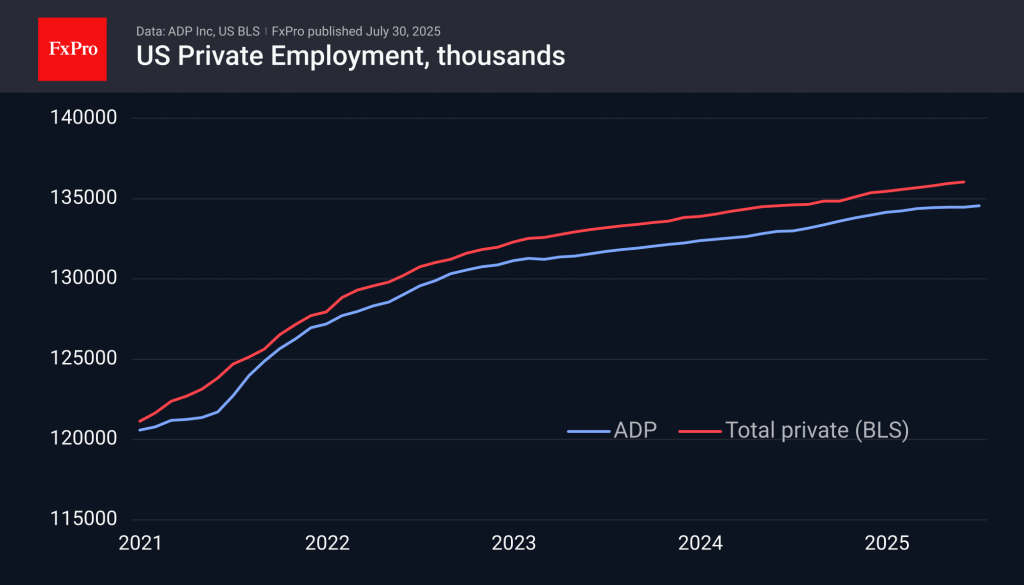

Private sector employment data released by ADP showed an increase of 104K jobs in July after a decline of 23K previously (revised from -33K) – better than expected and a noticeable improvement compared to the previous month.

According to the report, employment grew across all sectors of the economy, except for education and health services (-38K), despite steep changes in these sectors under the new US administration. The company commented that employers have become more optimistic about consumers’ resilience, which is an important sign of economic health.

This is positive news for the dollar, contributing to its upward momentum and setting the stage for an equally strong official employment report this Friday. The Fed’s decision on the key rate and accompanying comments, shedding light on the regulator’s next move, could either disrupt or reinforce the dollar’s recovery trend that has been forming this week.

The FxPro Analyst Team