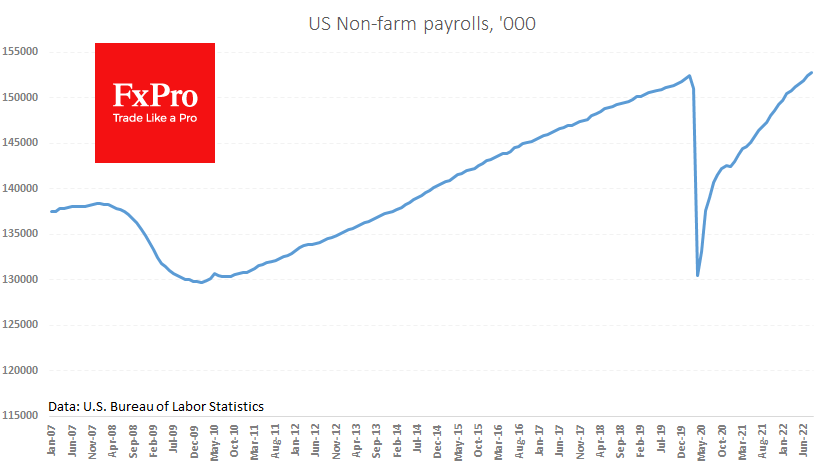

The US economy has created 315k new jobs, just above the forecasted 295-300K. The total number of employed people has surpassed the pre-pandemic highs with 152.7M. But, considering the natural population growth, the market is still not as tight as before March 2020. An increase of around 200K jobs monthly is considered neutral for the economy. In other words, there would have to be more than 5.5 million more jobs to replicate the pre-pandemic austerity.

As fears of the coronavirus subsided, the unemployment rate rose from 3.5% to 3.7% as more people joined the workforce. During the pandemic, the active labour force fell from 63.4% to a low of 60.2%, so the current recovery is only halfway there.

Higher inflation and the end of fiscal stimulus are working on getting Americans back looking for work sooner. This is not the most pleasant set of stimulus, so it should hardly be seen as a positive economic signal.

Either way, the Fed may build on the solid job growth of the last two months when it makes its key rate decision at its next meeting. If we are correct, we should expect a return of the sell-off to the stock market and further development of the dollar’s rising momentum in the coming days or weeks.

The FxPro Analyst Team