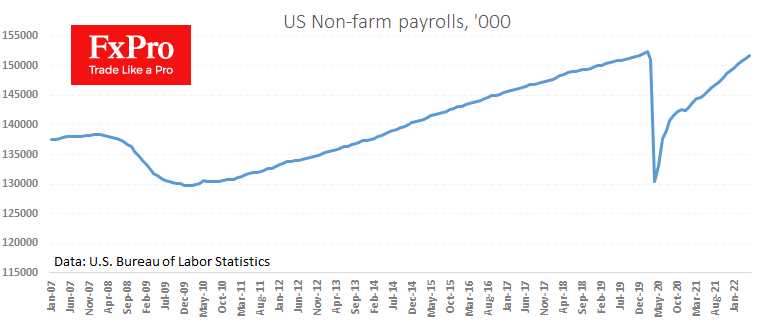

The US economy increased the number of jobs by 390k in May, the fresh NFP showed, better than average expectations (325k) but worse than April’s figures (436k). Total employment is only at 822k highs before the pandemic hit, and the labour market is increasingly bottoming out.

However, we point to a few spots that add to the arguments of those who see a reversal of the economic cycle.

The annual rate of wage growth has slowed down from 5.5% to 5.2% against an inflation rate of 8.3%. In other words, wages are hardly fuelling inflation in recent weeks.

Manufacturing, often the flagship of business cycles, added 18,000 jobs, three times weaker than in the previous two months, clearly losing momentum.

The share of the economically active population rose to 62.3% as more people struggled to find work amid rising prices and depleted savings accumulated during the pandemic thanks to stimulus packages.

This is not sound economic news, indicating a slowing economy. Initially, the markets may well be at the mercy of a sell-off in risky assets. But the more weak data we see, the more attention we should pay to FOMC members’ comments, which could dampen the pace of rate hikes.

The FxPro Analyst Team