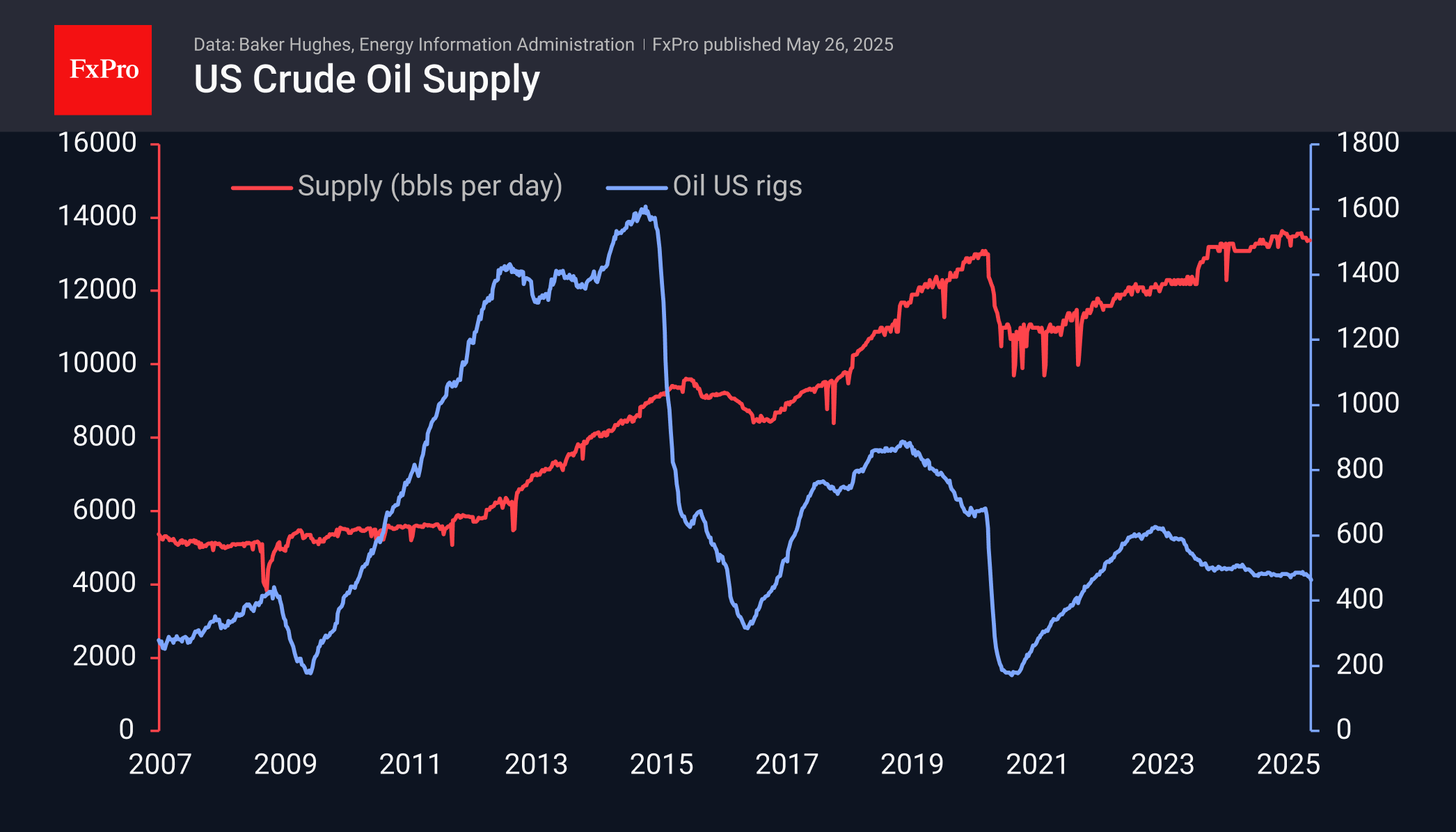

Oil producers are cutting back on activity in response to lower oil prices. As Baker Hughes reported on Friday, the number of oil drillers fell to 465 from 473 a week earlier, to its lowest level since late 2021. It just so happened that prices weren’t that far from current levels, but that was in the middle of a recovery in both production and prices.

Now, the decline in the rig count comes after a prolonged plateau. And it’s a step down, promising future declines in production volumes from current, near-record levels. It is believed that the effect of the change in drilling activity will manifest itself in 3-5 quarters. However, the scale of the decline in the number of drillers should not be directly translated into production volumes. Thanks to efficiency gains, the US is now producing 13.4 million barrels per day with just 613 drilling rigs — compared to the previous peak of 13 million bpd, which required 877 rigs. This is bullish news for quotes, but its impact has so far been more than outweighed by news from traditional producers.

At the same time, OPEC+ is giving new signals of willingness to increase production, taking back its share lost during the years of strict quotas aimed at pushing up prices. The cartel’s next meeting is in two days and is expected to announce plans to raise output by another 411K barrels from July, following a similar move in June. The continuation of this trend is a powerful bearish factor guiding oil towards $40 – the area of sustained cyclical lows of 2008 and 2015-2017, as well as the second half of 2020. The market has lower minimums, but they were not sustainable due to the market crash. So, the $40 area looks like long-term fundamental support.

The FxPro Analyst Team