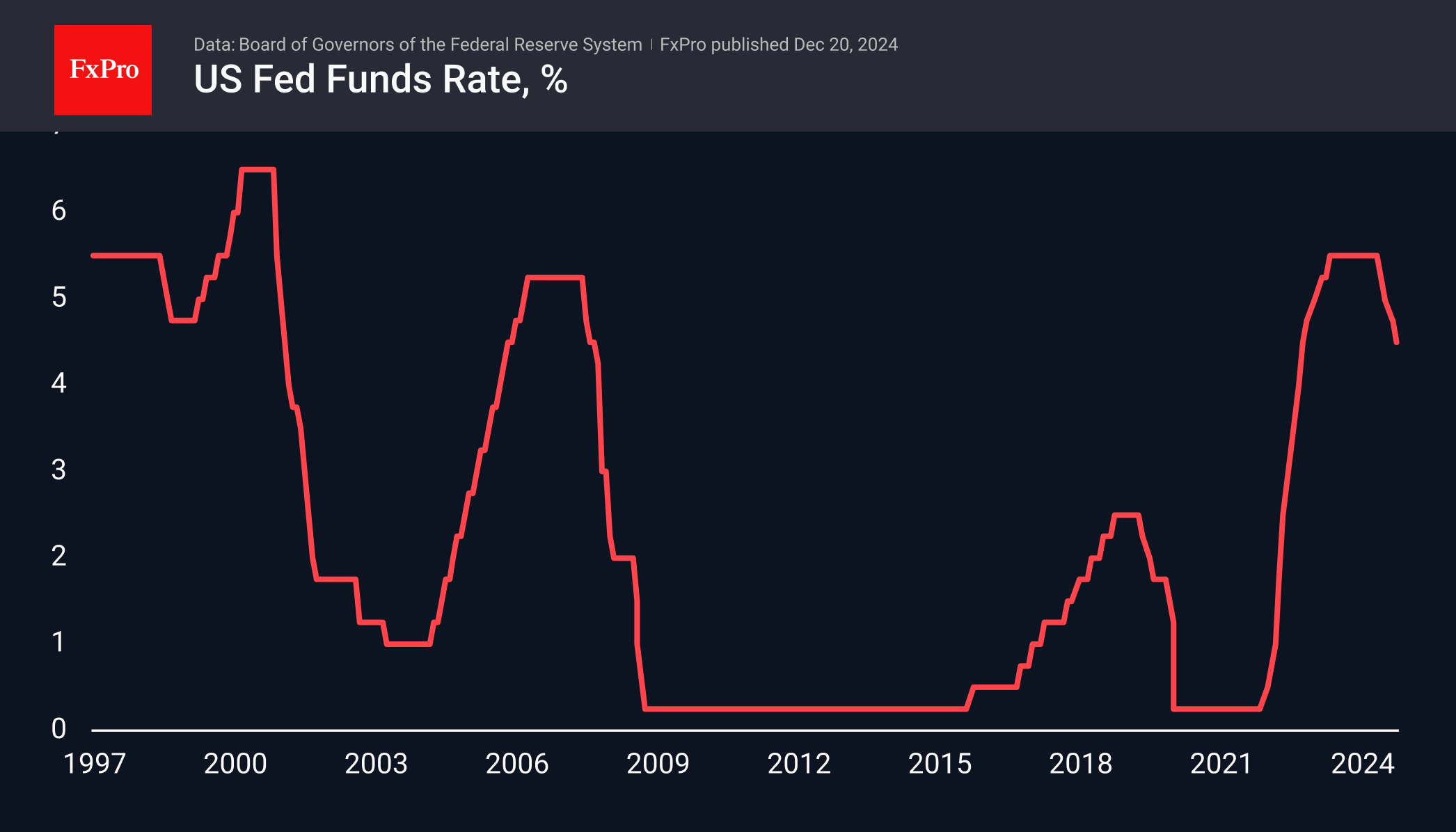

The U.S. dollar ends the year on a strong note, hitting two-year highs at 108.45. The Fed expects a 50-point rate cut for the full year 2025 versus 4 cuts one quarter earlier, citing higher inflation forecasts and a stubbornly strong labour market. This fundamental change has given a new impetus to the dollar’s rise that began in late September.

The fundamental reason is the change in the tone of the Fed’s monetary policy. Two consecutive 25-point cuts followed a 50-point cut in the key rate in September. Recent comments suggest a pause in January. The difference between current expectations for the end of next year and what was priced six months ago exceeds 100 points. Meanwhile, the euro, pound, and yen have much more modest six-month changes in expectations. Until September, this difference was against the dollar, but now it is becoming the driving force behind it.

The dollar’s strength is also the result of market speculation, expectations of intensified tariff wars, and fiscal stimulus expected from the Republican Party’s dominance of US politics since November. There has been no actual change yet, but there are signs that the Fed is beginning to incorporate these expectations into its policy.

The dollar index’s technical picture on the long-term charts is on the side of the bulls. Dollar buyers came in on the downturn under the 200-week moving average, turning the market up. In 2022 and 2014, the DXY rallied more than 20% after pushing off that line before consolidating. In 2019-2020, the opposite was the case, with a steady return to the mean culminating in a failure in the second half of 2020.

On the daily timeframes, DXY broke out to new highs after a corrective pullback of a couple of per cent, correcting to 78.6% of the upside from the October lows. A strong reversal to the upside proved the strength of the buyers, and exceeding the last peak confirmed the bullish bias. The next upside target looks to be the 112 area, which will be the exit to the 2022 highs.

In the context of EURUSD, the strengthening of the dollar brings it to the parity area. History suggests that the 1.0 level is unlikely to be a turning point. Either we see attempts to prevent a prolonged decline under 1.05, or buyers will emerge much later.

The FxPro Analyst Team