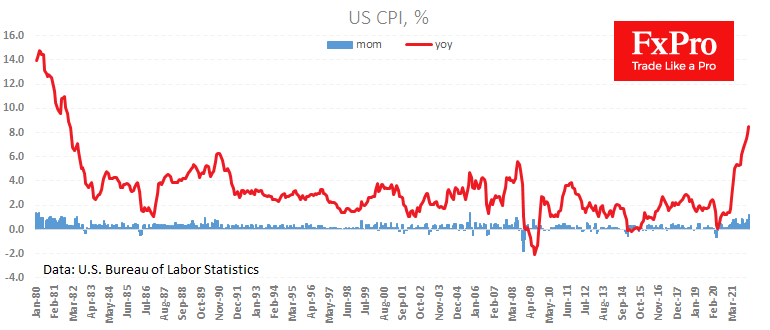

The US consumer price index has updated its record since 1981, accelerating to 8.5% y/y from 7.9% a month earlier and slightly stronger than the 8.4% average analysts forecast. However, yesterday’s White House warning of “extraordinarily elevated” inflation data set the numbers even higher.

Yesterday’s sell-off in equity markets and the pull into the dollar is essentially an attempt by traders to build upon the higher numbers after the “insider” from the White House, which gets the numbers a day early.

The core price index (excluding food and energy) rose weaker than expected, rising to 6.5% y/y.

The markets got a breath of fresh air as they saw signs that inflation was not on as destructive a trajectory as feared. In this environment, markets can bounce back from some overly extreme positioning.

We noted that yesterday markets laid down a 37% chance that the Fed would raise rates by 125 points over the next two meetings. The reassessment to a more realistic outlook provides local support to the equity market and forms a pullback of the dollar from the extremes reached yesterday.

In the longer term, one must consider that even with more down-to-earth expectations of 6 hikes of 25 points by the end of the year, combined with active asset sales from the balance sheet, a mix hardly compatible with a relentless bull market.

The FxPro Analyst Team