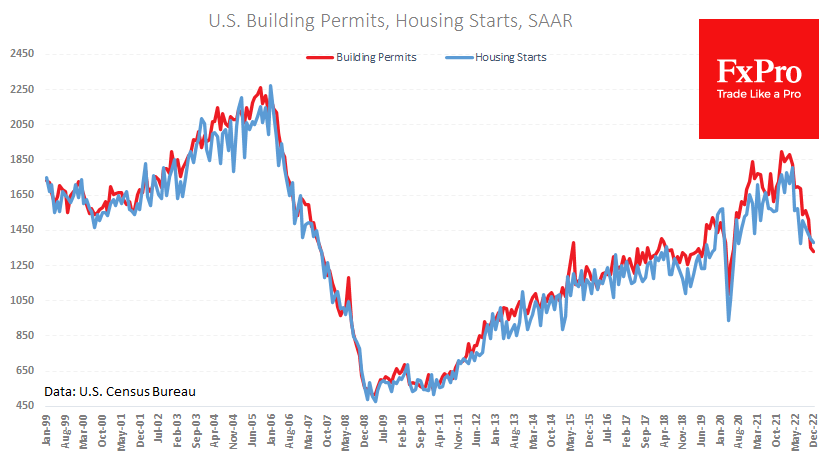

The number of building permits issued in the USA fell by 1.6% in December to 1,330k, the lowest number since May 2020. From the peak in March last year, the decline was 30%. The number of housings starts in December fell by 1.4% to 1,382k, down 23% from the peak in April last year.

The construction market volume is shrinking at about the same pace as it did during the housing bubble’s collapse in 2006. On the other hand, construction volumes are now about the same as we saw before the beginning of 2020. So far, we are seeing nothing more than the deflation of excess volumes but not the start of a collapse. The same observation is borne out by the comparative stability of new house prices in recent months (published in a separate report). The summer price volatility was not the start of a collapse.

A fall of another 5% in buildings or permits issued over the next couple of months would be well within the range of normalising the market to pre-pandemic levels. But a sustained fall below that would already signal an alarming slowdown in demand and the economy, which risks not only negatively impacting markets but could also force the Fed to soften its rhetoric more actively.

The FxPro Analyst Team