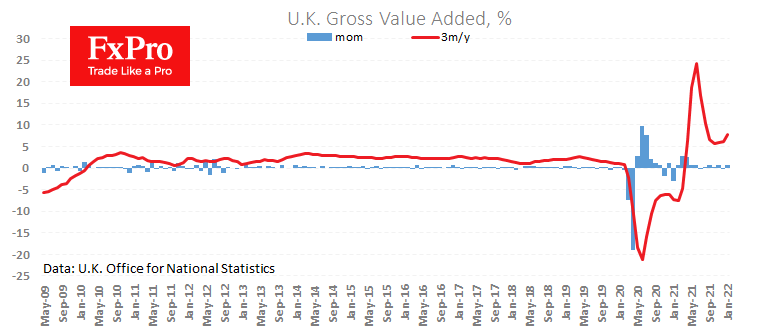

The new monthly package of UK statistics highlighted the fine shape of the economy in January. For the month, GDP rose by 0.8%, against an expected strengthening of 0.2% and the three-month growth rate accelerated from 1.0% to 1.1%.

Industrial production strengthened by 0.7% for the month and 2.3% for January 2021, also beating economists’ expectations.

The UK economy started the year in good shape, responding positively to the easing of the coronavirus restrictions.

This is short-term positive news for the British pound, which has managed to find support after touching another low since November 2020 at 1.3080 per dollar. A strong base in the economy will allow the Bank of England to strengthen its fight against inflation by raising rates.

However, price shocks across many commodities and foodstuffs dramatically increase the chances of short-term stagflation in the UK as consumers will save more by cutting back on purchases of non-essential goods and services due to rising energy and food prices.

The Ukrainian war crisis, now in its third week, has seen the GBPUSD fall 3.8%, taking more than 1/3 of the pair’s rise from the lows at the start of the pandemic. A move below 1.3160 was a signal to a move into a deeper correction phase, and the pair could plunge to 1.2880 at the beginning of next week.

The FxPro Analyst Team