The UK employment statistics package failed to inspire the currency market to buy the Pound. The released data showed a slowdown in the labour market, which is still far from recovering to pre-coronavirus levels.

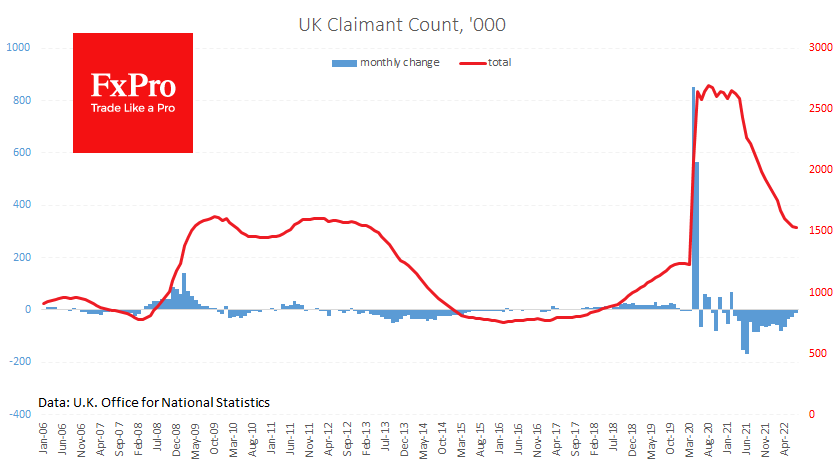

Analysts were tuning in for acceleration, as in the US, but didn’t get it. The number of jobless claims in July decreased by 10.5 thousand against 26.8 thousand a month earlier and the expected 32 thousand. The number of people receiving benefits amounted to 1.53 million, 0.3 million more than before the first lockdowns. That said, the pace of recovery has slowed sharply in recent months.

The negative backdrop has been somewhat diluted by a slightly less dramatic than expected slowdown in wage growth. The increase, including bonuses, has slowed from 6.4% to 5.1% over the past three months to the same period a year earlier. Even beating analysts’ expectations, wage growth has not kept pace with inflation, which is not good news for the Pound.

The waning economic growth will deter the Bank of England from taking more decisive steps in tightening monetary policy, widening the gap between interest rates in pounds and dollars, and attracting more capital to the latter.

The statistics package did not help the British currency, which is losing ground against the dollar for the fourth consecutive trading session. GBPUSD has now rolled back to 1.2015 after a second failed attempt to develop gains above 1.2250. The Pound has again been under increased pressure after the corrective rebound in the second half of July. We should be prepared for bears rather than rested bulls now returning to the trading desks from their summer holidays. In this case, the second half of August could manifest and intensify negative market trends, returning GBPUSD to another test of the July lows at 1.1750.

The FxPro Analyst Team