Monthly estimates showed that the UK economy added 2.5% over the three months to July vs the same period a year earlier. The negative surprise was a 0.3% decline in Industrial Production in July compared to expectations of a 0.4% gain after a 0.9% slip in June. Production added a modest 1.1% compared to July last year.

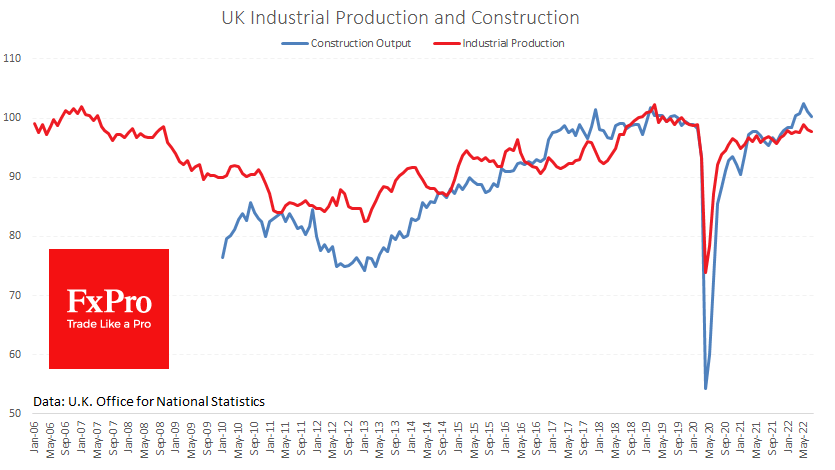

Construction and industrial production indices are back in the 2019 range after a quick dip and subsequent recovery due to the pandemic. And they are stagnating for some time around these levels. Manufacturing and construction are at the forefront of the economic cycle, and their message is not optimistic.

Foreign trade is much more dynamic. Import values have fallen for two months after ballooning during the year’s first five months, while exports have remained close to the highs. These local dynamics have reduced the foreign trade deficit to its lowest level since December 2021.

The narrowing of the foreign trade deficit is positive for Sterling as it reduces capital outflows from the country. On the other hand, if the weakness in imports is linked to stagnant domestic demand and production, it does not carry anything good in the medium term. GBPUSD seems to have pushed back from the bottom in the middle of last week, but this dynamic is more attributed to the USD profit-taking after the rally rather than investments in the pound.

The FxPro Analyst Team