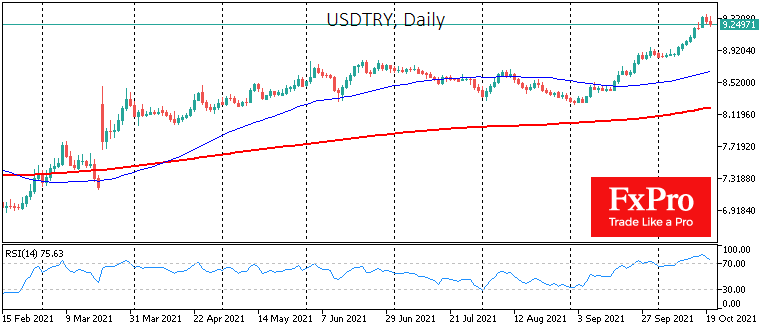

Energy prices halted their growth, while optimism in global markets continued to gain momentum. In this environment, the Turkish Lira has paused its weakening, closing Tuesday with gains against the Dollar and Euro after eight consecutive sessions of decline.

In addition, the break in the Lira sell-off may continue in anticipation of Thursday’s Bank of Turkey meeting. Last time, the central bank cut its key rate by one percentage point. However, since then, new data has pointed to a further acceleration in inflation. In addition, rising energy prices and a weaker lira are further pushing up prices due to higher import costs.

Under such circumstances, it is logical to expect that the Turkish central bank, which managed to surprise with a rate cut last time, will not cut its funding costs this time and could signal that it is set to fight against rising prices, or at least show concern about it.

The FxPro Analyst Team