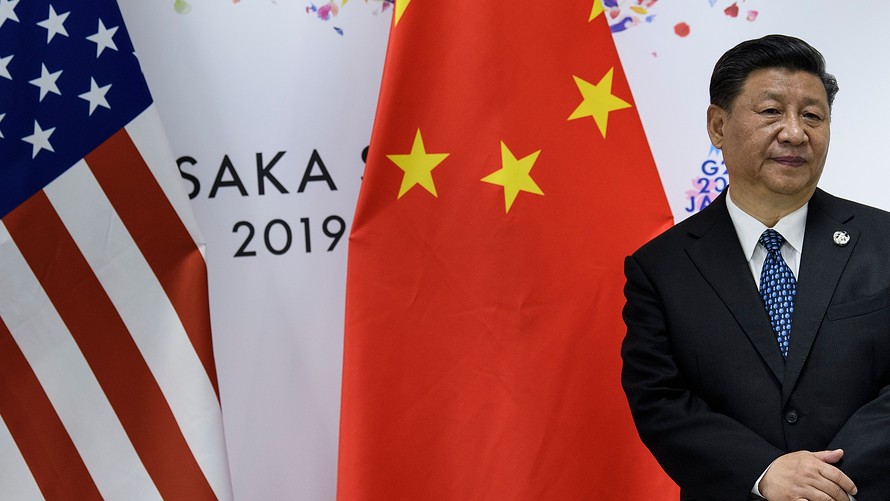

The great U.S.-China trade war is all over but the shouting. In a meeting on the sidelines of the G-20 summit in Osaka, Japan, President Donald Trump and Chinese President Xi Jinping agreed to resume trade talks that had broken down in May. Trump will lift some restrictions on Huawei Technologies Co. Ltd.’s ability to do business with U.S. companies and will postpone tariffs he threatened to impose on an additional $300 billion annually in Chinese imports. In exchange, Xi agreed China will buy more U.S. agricultural products. Details will be spelled out later.

This deal — the second time President Trump gave in to China’s demands and ended restrictions on a major Chinese technology company that had been accused of threatening U.S. national interests — effectively marks the end of Trump’s trade war with China.

Why? Because it shows the president won’t go to the wall to fundamentally change the U.S.’s trade relationship with the world’s second-biggest economy. The Chinese president has clearly calculated his American counterpart is unwilling to do anything that would threaten his support among key constituencies, like farmers, as the 2020 election looms. (President Trump also has backed down big time from his bellicose talk on North Korea and now appears ready to tacitly accept Pyongyang as a nuclear power.)

Meanwhile, Huawei’s CFO, Meng Wanzhou, the daughter of company founder Ren Zhengfei, is fighting extradition from Canada to the U.S. on fraud charges. The U.S. government alleges she helped trick financial institutions into violating U.S. sanctions against Iran. Huawei has denied the allegations. If the charges against her are dropped, that will only make President Trump’s capitulation official.