Gold’s hopes for an aggressive cut in the Fed’s federal funds rate, the associated decline in Treasury bond yields, and the weakening of the US dollar have not yet materialised. The Fed is likely to ease monetary policy in September. However, it may then pause again. Its slowness is bringing investors’ interest back to the greenback.

Clouds are gathering over the precious metal due to Donald Trump’s efforts to end the armed conflict in Ukraine. The start of hostilities, followed by the West’s freezing of Russia’s gold and foreign exchange reserves, was the starting point for the Gold’s rally. Since February 2022, gold has risen 1.7x and reached a record high of more than $3,500 per ounce in April. The rally was driven by de-dollarisation, active buying of bullion by central banks, and increased demand for ETFs.

In the second quarter, central bank activity in the precious metals market declined significantly, and capital flows into specialised exchange-traded funds slowed. Without these advantages, XAUUSD can forget about recovering the upward trend. However, the favourable external background in the form of monetary stimulus from the Fed, lower Treasury yields, and a weaker US dollar in the medium term will give gold a boost.

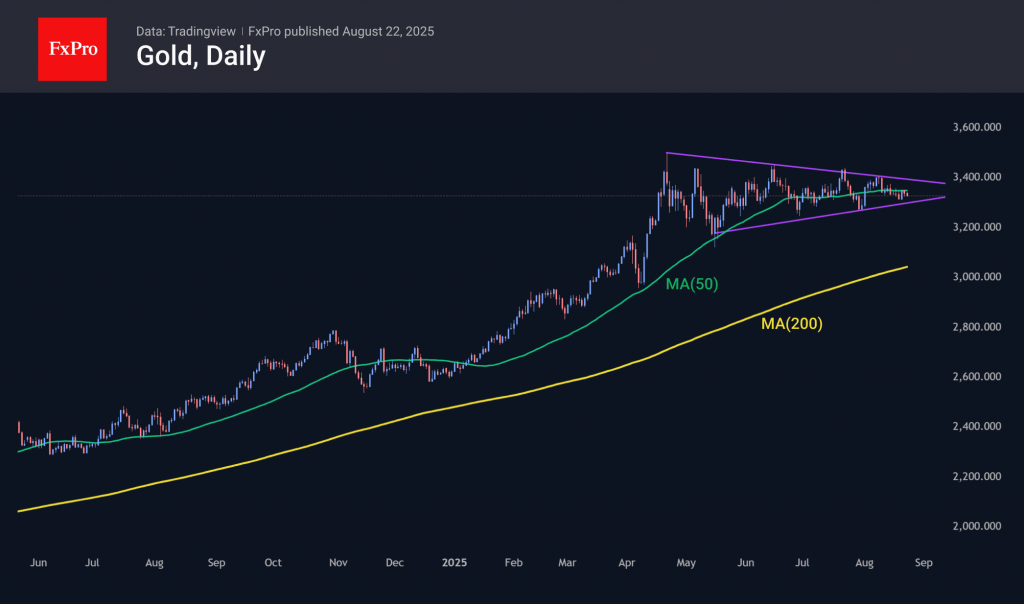

The gold chart clearly shows consolidation since April, with the price right in the middle of the 12% range from peak to correction lows. This tedious five-month movement to the right is likely to end in the coming weeks, as August often marks the start of major trends in gold. The duration of consolidation is often directly proportional to the strength of the breakout.

From a technical analysis perspective, given the accumulated overbought condition, the downside potential is huge – up to $3000 or even $2200 per ounce. However, the upside potential is no less impressive: $4600 in an extreme bullish scenario, including the Fed switching to a mode of absolute softness.

The FxPro Analyst Team