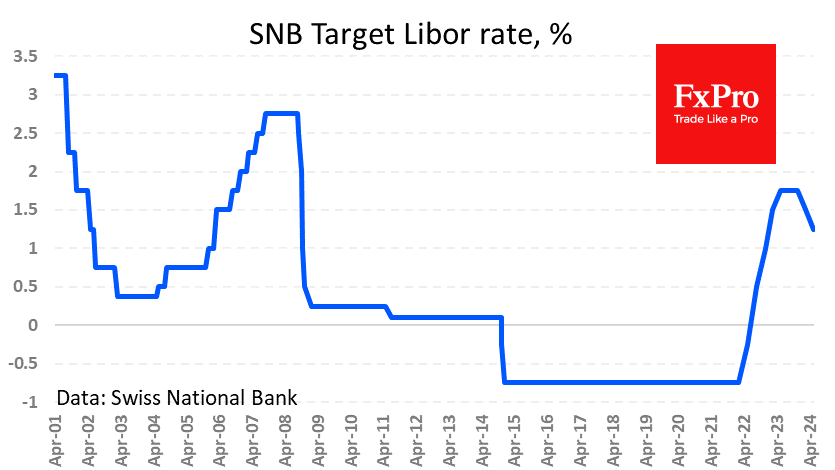

The Swiss National Bank cut its key rate by 0.25 percentage points to 1.25%. The decision surprised markets, which, on average, expected no change after a similar move in March. The SNB also issued a warning that it is ready to intervene actively on FX if necessary.

Even with the key rate cut, the Swiss Central Bank forecasts inflation of 1.4% in 2024 and 1.1% in 2025. This is well below the 2% target by a wide margin and 0.1 percentage point less than forecasted three months ago. This potentially opens the door to further policy easing in the coming months.

The strong franc was also likely a factor in favour of a softer tone on rates. USDCHF lost over 3.5% in the month to Wednesday, contrasting with the dollar’s 1.5% rise against a basket of major currencies over the same period.

The CHF lost around 0.5% to major peers immediately after the rate decision. As was the case in March, it is worth being prepared that this is just the beginning of the move, as markets will smoothly implement the changes in quotes.

However, the franc is unlikely to weaken as much as it did after the March decline when it lost about 3.5% in three weeks. The ECB and the Bank of Canada have already started their policy easing, and the Fed is expected to make such a move in September.

In our view, USDCHF has a high chance of returning above the 200-day moving average, heading towards 0.9020 (April-May support area). In turn, EURCHF may return to the 0.9680-0.9700 area.

The FxPro Analyst Team