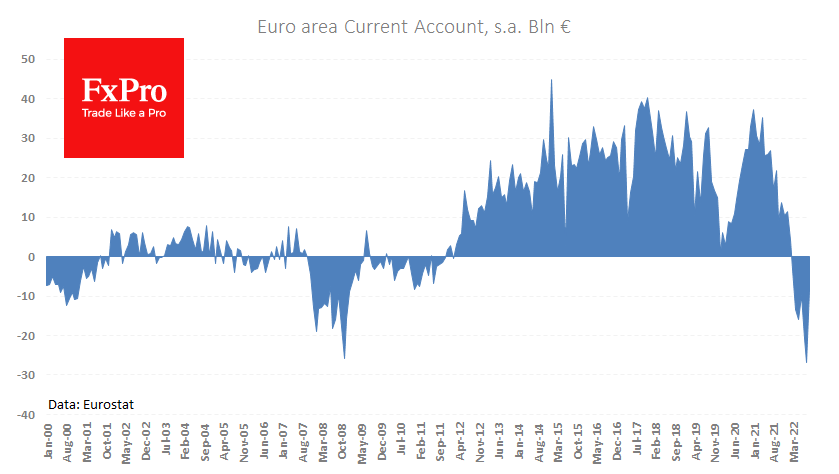

The balance of payments deficit in the eurozone in September was much smaller than expected at 8.1bn compared to 26.9bn a month earlier and the expected 20.3bn. Such a considerable difference was explained by a fall in the capital outflow of 3.3% or 15.8bn. Meanwhile, the inflow rose by another 0.6% or 3.1bn, renewing a historical high.

Interest in goods from the eurozone in September was boosted by the low euro exchange rate, which fell to a 20-year low of $0.96 at one point.

A much smaller balance of payments deficit is good news for the euro as speculators’ reassessment of the outlook for capital inflows/outflows may follow. As it turns out, flows have already fallen at the worst times for the euro exchange rate. This could be a significant signal of a trend reversal after almost a year of outflows.

It is now worth looking at how the Euro-region industry will behave. If it exploits the euro weakness to increase exports systematically, that will signal a long-term trend reversal and a EURUSD pullback from the 20-year lows.

The FxPro Analyst Team