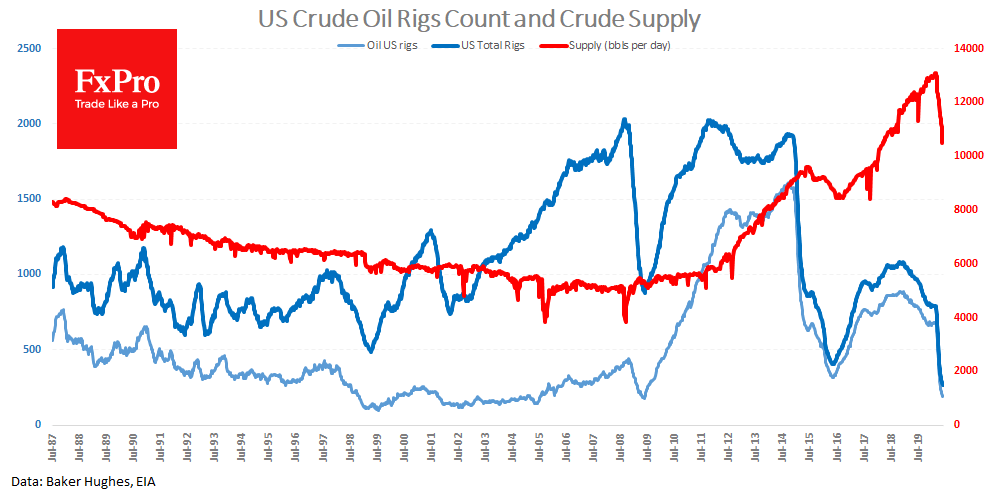

American companies continue to cut production and drilling activity despite the growth in oil prices. The data published on Friday showed that the number of oil rigs fell to 189 (-10 per week). The situation now indicates the end of the oil shale boom in the U.S.A. The number of oil-producing drilling rigs has returned to the values we saw from 1999 to 2009. The situation with gas is even worse. At the beginning of the century, the share of gas production drilling rigs exceeded 60%. Now it has more than halved to 28.2%. On the whole, all this is turning into a very alarming picture for the American oil production industry.

The total number of drilling rigs (oil + gas) fell by 16 to 266 last week to a new historic low. Before that, the lowest point was 408 in mid-2016.

Despite the dramatic decline in drilling activity, oil production in the U.S. has steadily increased since 2016, reflecting a fundamental increase in the returns from one well. However, production records in early 2020 may also well be a legacy of 2010-2016. Having drilled wells then, with oil near $100, they laid the foundation for production records later.

Later on, they enjoyed the results of previous years. Oil prices remained depressed, forcing the companies to save on new investments in exploration and drilling. The oil companies were loaded with debts, which they tried to fight against by increasing production to get high cash flow. However, these actions seem to have taken away their future.

Chronic underinvestment prevents companies from using oil price recovery to boost drilling activity, as was the case in 2016. At that time, the number of operating drilling rigs quickly shifted to growth, as did production.

This is not happening now. Moreover, new data showed a drop in production in the U.S. by 0.6 mln to 10.5Mbblpd the lowest since March 2018.

Separately, it is worth mentioning the deepening problems of the U.S. oil producers. On Friday, Fitch reported that the growth in the default rates for U.S. companies is approaching 4% following a jump to 17% in the energy sector. The share in the energy sector is expected to rise further to 18% by the end of the year and to 15% for the business sector.

All this suggests that the Americans will be watching from a distance the further growth in oil prices. The recovery of quotations is likely to stop the wave of defaults but will keep the overall figures very high. The debt load of oil shale producers reduces the chances that the creditors will again agree to finance the new boom in the industry, having received losses from the first wave. The situation is further complicated by the fact that in addition to the energy sector, the creditors will observe defaults in many industries, which was not the case in 2016 when only oil suffered. This will severely reduce the demand for risk from investors in the U.S. energy markets.

The FxPro Analyst Team