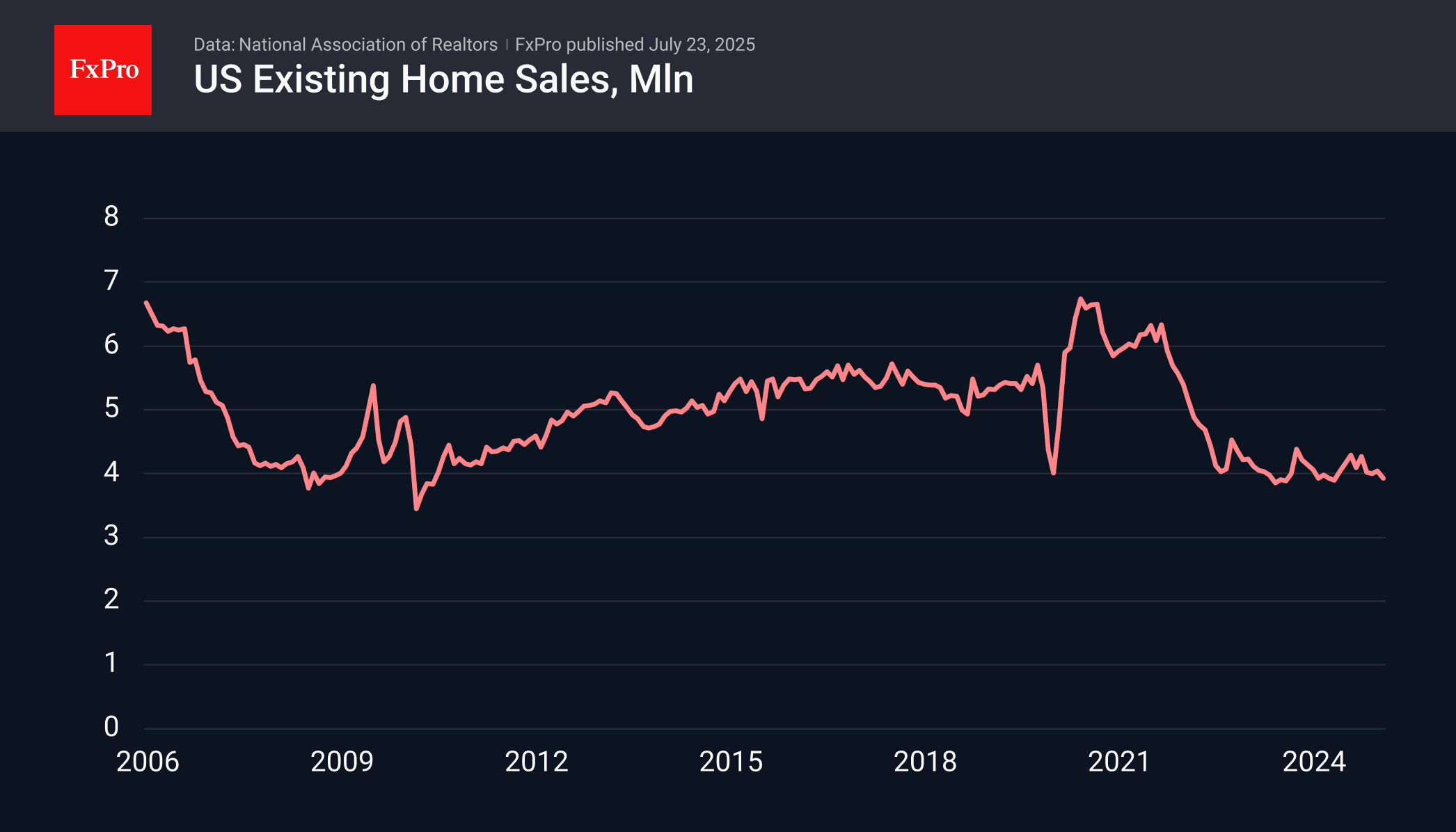

Sales of existing homes in the US fell by 2.7% in June to 3.93 million on an annualised basis, down from 4.04 million a month earlier and below the expected 4.01 million. Since the end of 2023, the 4 million mark has been the lower limit for sales volumes in the market, which is below the low point during the first lockdowns and corresponds to the sales rates of 2011.

Last month, we also saw a continuing trend of growth in the share of unsold homes: current inventories are sufficient to cover 4.7 months of sales at the current rate. This is a nine-year high, in sharp contrast to the ratio of 1.6 at the beginning of 2022.

These generally negative signals from the leading developed economy increase the scope for lowering the key rate, indicating that the market is far from overheating. Although the median sale price reached a new all-time high of $435,300, this is only 1.9% higher than a year earlier.

The housing market remains weak, despite the high stock market prices, which draw parallels with the situation at the beginning of the century that preceded the global financial crisis.

The FxPro Analyst Team