Market Picture

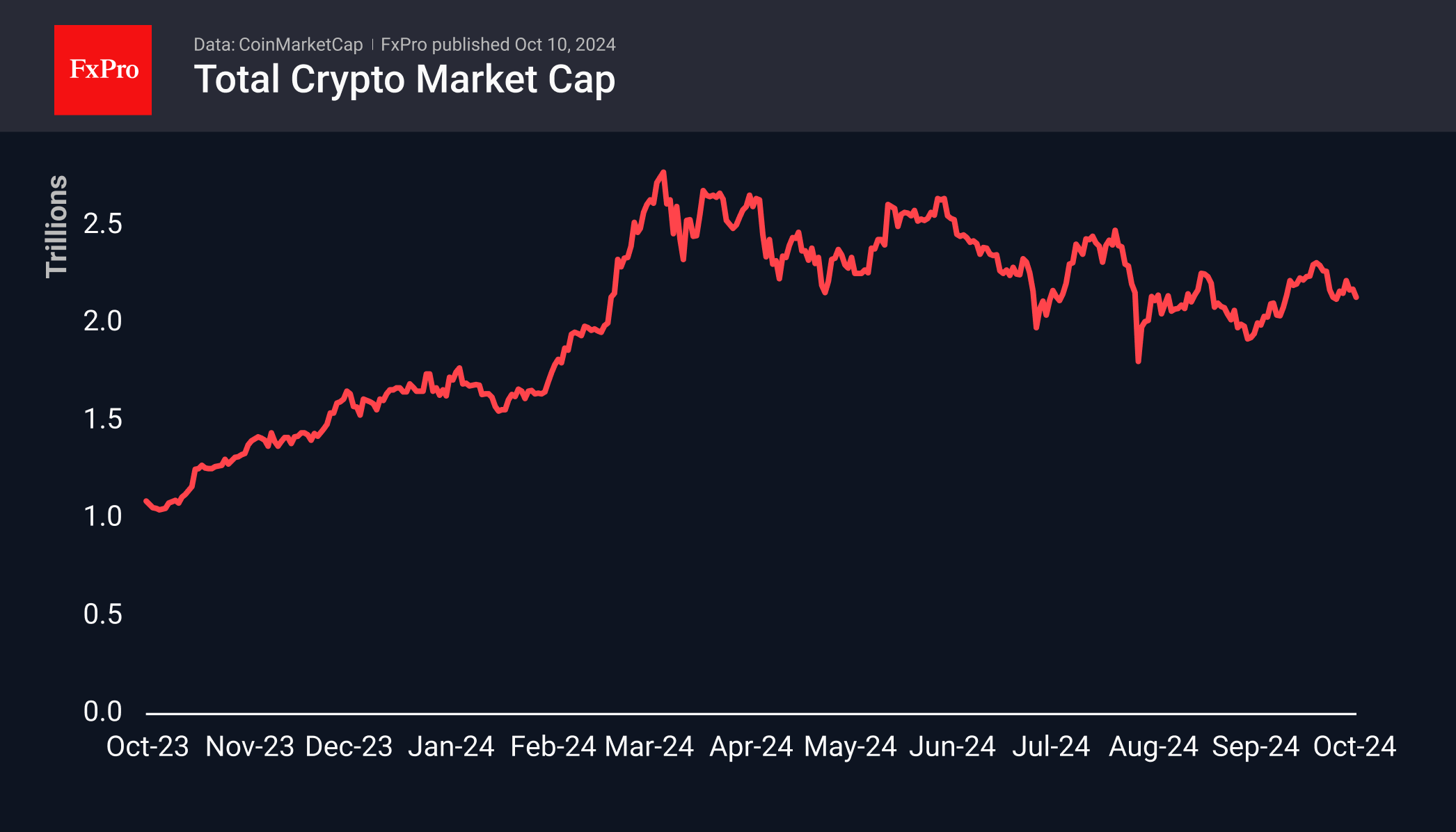

The cryptocurrency market lost 2.2% in 24 hours to $2.13 trillion, continuing to slide despite the S&P500 index making a solid update to all-time highs. The Asian market is generally picking up on America’s positive momentum, helping cryptocurrencies recover from Thursday morning. Crypto sentiment has moved back into the fear zone (39), reinforcing the contrast with 72 (greed) in equities. This dynamic is easily explained by the appreciation of the dollar and the increased attractiveness of bonds, which reduces institutional traction in bitcoin.

Bitcoin lost around $2000 (over 3%) on Wednesday, falling to a 6-day low of $60.5K. It was a fresh attempt to break through support at the 50-day moving average, which has so far been unsuccessful as the price returned to the $61K area, and yesterday’s local lows were above the lows from earlier in the month.

On Thursday, volatility risks for the financial market will revolve around the monthly US inflation report in case it deviates from expectations. For Bitcoin, this is enough to both break support and start a new rally.

News Background

According to Glassnode, the cryptocurrency market could see increased volatility due to liquidation risks and a mixed macroeconomic picture. The average acquisition cost of BTC by short-term investors now stands at $62,500, and the formation of a new wave of selling from this level will put pressure on recent buyers.

MatrixPort predicts that institutional investor interest in digital assets and economic uncertainty could lead to global cryptocurrency adoption rates exceeding 8% by 2025. This would signal the potential transition of cryptocurrencies from a niche market to mainstream financial systems.

According to CoinGecko, US regulators have recovered $32 billion from cryptocurrency companies as part of compliance settlements. Of the total, a record $19.45bn came in 2024, driven by $12.7bn paid to FTX and Alameda.

According to a new study by Social Capital Market, Dubai, Switzerland, and South Korea were this year’s top cryptocurrency jurisdictions.

The FxPro Analyst Team