Bitcoin is trading in the red near $10,400 at press time, down 4% on the day, having faced rejection near $11,000 earlier on Monday. A decline in European stocks and U.S. stock futures and a rise in the U.S. dollar look to be weighing over the top cryptocurrency by market cap.

Major European indices like Germany’s DAX, France’s CAC, and the U.K.’s FTSE are down more than 3%, according to data source investing.com. Futures tied to Wall Street’s S&P 500 index are also down nearly 2%, but the dollar index, which tracks the greenback’s value against major currencies, is up 0.5%.

Investors are selling equities on fears the recent resurgence of COVID-19 cases across Europe could unleash a new round of economic damage. The epidemic is doubling roughly every seven days in the U.K., and if the trend continues there would be about 50,000 new cases per day by the middle of October, according to British government’s chief scientific adviser.

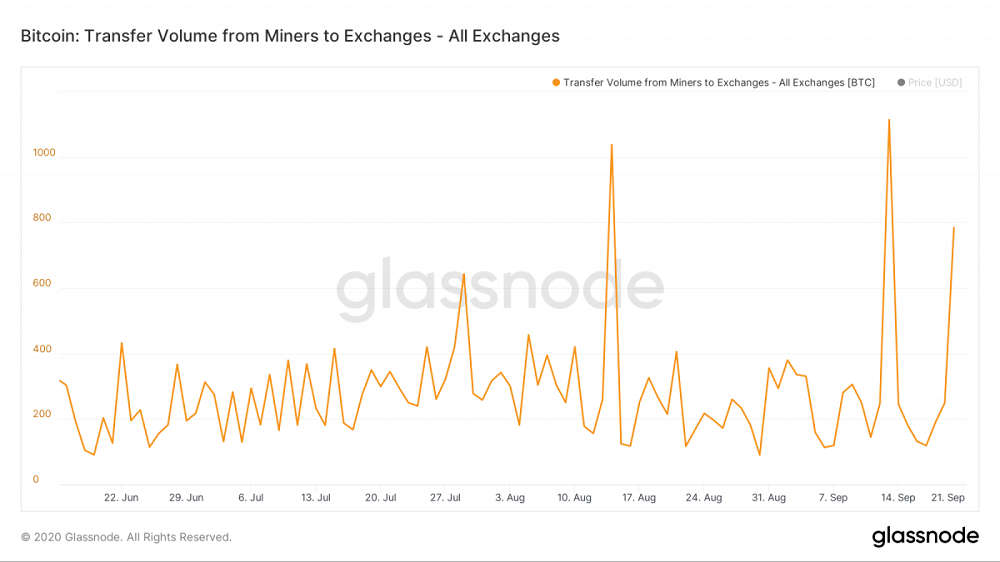

On Sunday, 784 BTC (worth roughly $8 million) were transferred to exchange wallets from miner wallets – significantly higher than the 30-day average daily outflow of 265 BTC, according to data source Glassnode. Miners and investors usually move coins to exchanges to liquidate their holdings. As such, a price drop and a pick-up in volatility could be in the offing, unless buying pressure is strong enough to absorb the additional miner supply.

A possible head-and-shoulders breakdown, a bearish pattern, seen on the hourly chart may expose the 100-day average support located near $10,400. Meanwhile, resistances are seen at $11,000 and $11,183 (Sept. 19 high).

Bitcoin Down as Stocks Fall Over European Coronavirus Fears, CoinDesk, Sep 21