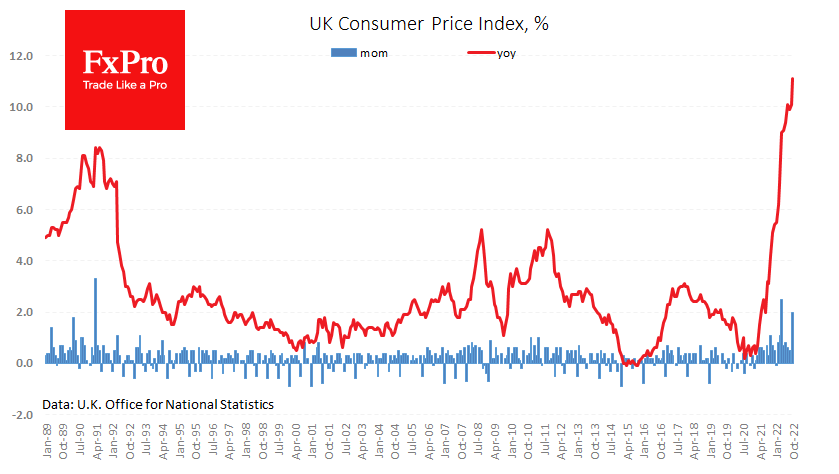

The UK Consumer Price Index delivered another “positive” surprise, adding 2% for October, above the average forecast of 1.7%. Annual inflation accelerated to 11.1% against 10.1% previously and the forecast 10.7%. Inflationary pressures are much stronger here than in the USA and China, which reported a stronger-than-expected slowdown last month but are in line with continuing escalating price tensions in Europe.

Producer prices are slowing their growth rate. PPI input prices added 0.6% m/m and 19.2% y/y against 20.7% a month earlier and peaked at 24.3% in June. From July to October, this index added 0.66%, suggesting an annulated increase of just under 2% – a decisive cooling, though not a price correction.

The PPI of producer price output slowed to 14.7% from 16.3% in September and a peak of 17.3% in July. For the three months, the index added 0.8%, reaching a trajectory of 3.3% in annulated terms.

Producer price development suggests that the following inflation report in November will show a deceleration of consumer price inflation. So, the current 11.1% y/y CPI could be the peak level for years.

Investors and traders are more concerned about how this will affect Bank of England policy and, thus, the British markets. It may not affect it because the BoE had earlier forecasted inflation beyond 11%, so inflation stays on the trajectory that the BoE envisages.

Anyway, the central bank’s comments will not be long in coming as there will be a hearing of its members in a special parliamentary committee later today. As these hearings coincide with the release of the new inflation data, the focus will be on this issue.

The Bank of England will likely highlight the work on rate hikes that started in November 2021 and hint at further hikes in the foreseeable future in increased increments of 50-75 points. It also cannot be ruled out that hawkish comments will accelerate the strengthening of GBPUSD into the 1.2200 area, from where we saw the start of the last peak in August. A decisive move higher would signify the markets’ belief that the UK is on the road to recovery, having avoided the worst-case scenario.

The FxPro Analyst Team