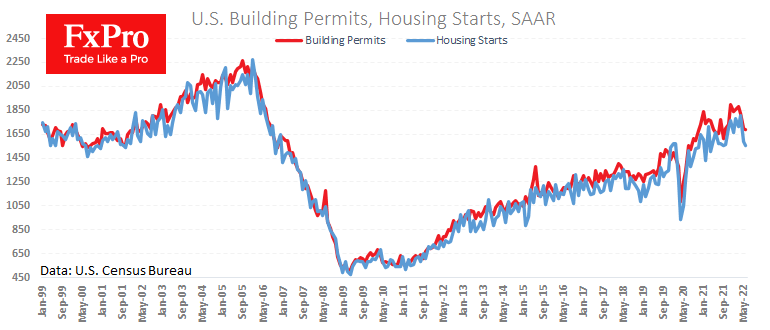

The gradual cooling of the US housing market continues, although the pace has softened somewhat. Fresh data showed a 0.6% drop in building permits issued to 1,685K (seasonally adjusted annualised rate) in June, following declines of 7% and 3% in the previous two months and 11% below the peak in December.

The number of construction starts fell 2% to 1,559K after dropping 11.9% a month earlier and 12% below the peak in December.

The current peak levels are below the historic highs before the global financial crisis, reflecting the Fed’s slightly greater caution in preventing bubbles in the housing market.

We should also expect that borrowers’ quality and ability to make timely payments will be higher this time. This time Americans have a much more impressive safety cushion. Furthermore, the labour market continues to create jobs at a rate above the trend rate of 200K per month.

On balance, the cooling in the construction sector should hardly be seen as a factor keeping the Fed from aggressively tightening policy in the middle of next week. Right now, we are only seeing early signs that key rate hikes and the accompanying rise in mortgage rates are cooling the housing market rather gently.

The current slowdown could cause concern if it turns into a sustained trend before the end of the year. In that case, a reversal of Fed policy from tightening to easing could be closer than the markets currently estimate (at some point in 2024).

Forecasts for the start of the Fed’s easing cycle are now becoming the main driver of the FX market. The dollar is locally under pressure from its overbought position, which has accumulated over a year of growth. It would not be surprising if, during the coming week, the US currency corrects its previous rise while market participants take a wait-and-see attitude to the Fed’s statements and actions.

The FxPro AnalystTeam