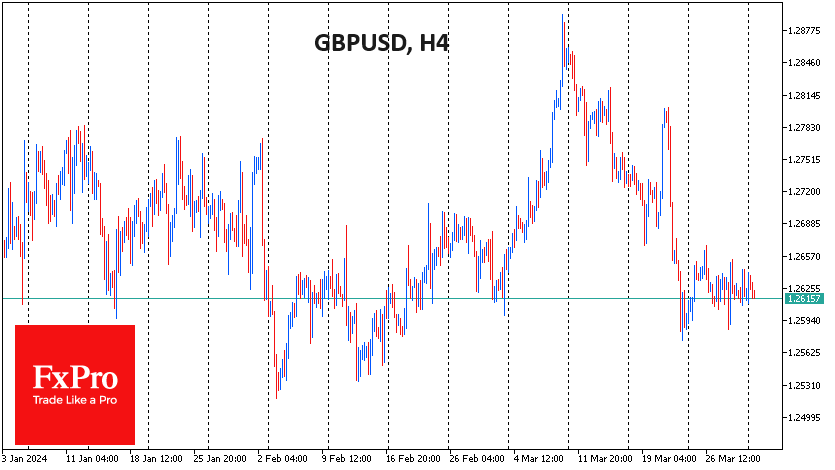

The British Pound has spent the past week in a tight 500 pip range but has mostly traded around the 1.2620 level. Attempts by the bears to send the GBPUSD into a downtrend like the EURUSD have so far failed, with the pair finding buyers on dips towards the 200-day moving average (now at 1.2590) since last November. It looks more like a temporary stalemate against the backdrop of the euro, franc and yen downtrends and the Canadian dollar’s unimpressive momentum.

In terms of moving averages, the uptrend was broken in the early days of February with a sharp dip below the 50-day MA. However, the dip below the longer-term 200-day MA lasted only a few hours. There was even a false attempt to bounce back from it in early March. But it was more of a false breakout, and the pressure on sterling quickly returned.

The market driver since the beginning of the year has been the comparison of monetary policy between the US and other developed countries. Last year ended with expectations of four or five Fed rate cuts, with the first in March; now, the probability of more than three cuts is estimated at 33%, starting in June (68% probability). Expectations for the Bank of England have not changed so dramatically. The first cut is still expected around the middle of the year, and for the whole year, 2-3 cuts are expected, down from 3-4 at the end of December.

A consolidation below the 200-day MA looks more like a matter of “when” than “if”, as the dollar tends to strengthen against its major peers. The Pound is in better shape than most of the major currencies, given the less dovish outlook for monetary policy. However, it can rarely swim against the tide for long. Europe has shown time and again that it can move quickly: the Bank of England started raising rates five months before the Fed, and the Swiss National Bank unexpectedly started easing at the end of March.

A GBPUSD fix below 1.26 will draw attention to the pound from those following long-term trends. A break below 1.25 will be an important signal that the market has decided its direction, which will signal the taking of a psychologically important level and confirm the breakdown of support in recent months.

The FxPro Analyst Team