The British pound has been losing ground against the US dollar for the third day in a row, falling back to 1.35. This trend runs counter to the news coming out these days, which could be either an early indicator of a change in market conditions, a short-term technical shake-up, or traders’ concerns about the political situation in the UK.

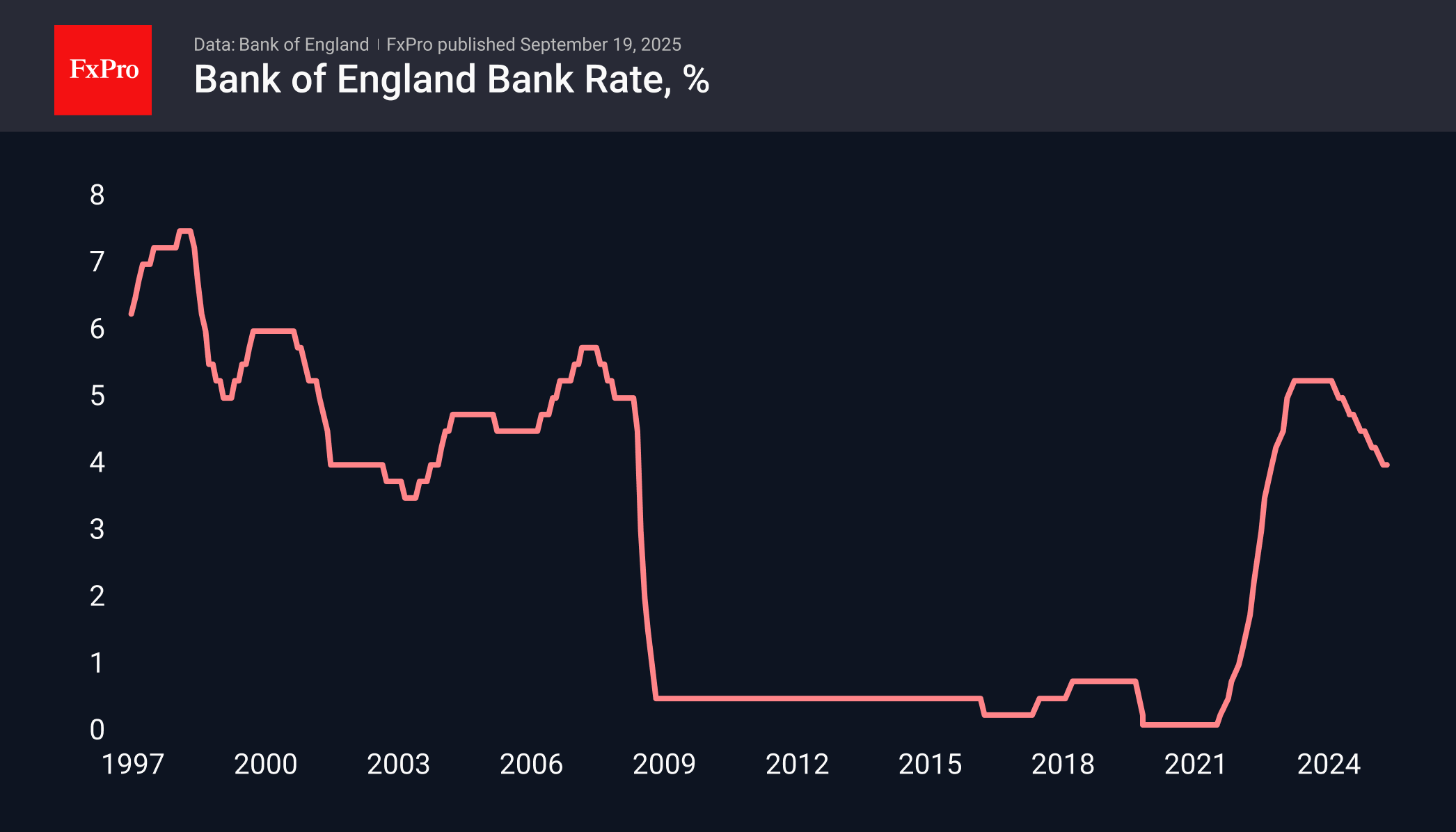

On Wednesday evening, the Fed cut its key rate, predicted two more cuts this year and indicated its readiness to ease policy in 2026. The Bank of England, on the other hand, kept its rate unchanged at 4.0% on Thursday, and market analysts concluded from the accompanying comments that there would be no further easing this year.

The balance of macro data was also in favour of the pound. The UK labour market is cooling but not collapsing, and the UK figures for wage growth and hiring are still significantly better than the US figures. Overall consumer inflation in the UK is 3.8%, and core inflation is 3.6% year-on-year, significantly higher than 2.9% and 3.1% in the US, respectively.

Friday morning’s UK retail sales data, excluding fuel costs, added 0.8% m/m against expectations of 0.3% after 0.4% a month earlier.

However, this did not help the pound at all; it only increased pressure, pushing it to a two-week low against the dollar and a six-week low against the euro. EURGBP is trading at 0.8710, just 40 points below the year’s highs and at the very edge of the upper limit of the range for the last two years.

This week’s dynamics are reminiscent of the resistance at 1.3800, which the pound has been unable to break through consistently since the beginning of 2022. There is still no confirmation of the assumption that GBPUSD has completed its corrective pullback and is preparing to reach a new level. We are surprised by this dynamic, but we are sceptical about its sustainability, as it currently contradicts macroeconomic indicators. However, political turmoil is undermining confidence in British assets, simultaneously suppressing the GBP and FTSE100.

The FxPro Analyst Team