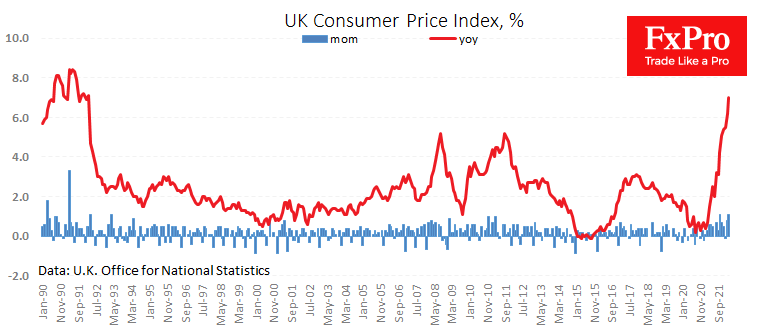

Inflation in the UK is developing an acceleration stronger than expected. Estimates for March marked a 1.1% CPI gain for the month, above the 0.8% a month earlier and rebutting analysts’ hopes that the monthly price growth would slow to 0.7%. The year-over-year inflation rate has accelerated from 6.2% to 7.0%.

As in most of Europe, leading inflation indicators show that pressure will only increase in the coming months. Output producer prices rose by 2% in March, the most significant jump since May 2008. Producer input prices jumped by 5.2% in just one month. In the more than 40-year history of this indicator, there has only been one such jump – in November 1979. At that time, we also saw a comparable annual increase of 19.2% for Input and 11.9% for Output Producer Price Indices.

Such a jump in producer prices sets up that the pressure on consumer prices will not abruptly ease in April and May.

Just like an emerging market currency, the British pound reacted to the above-expected price hike by falling. In response to inflation, the weakening of the currency shows concern about whether the central bank can get prices under control before their rise destroys a sizable chunk of the pound’s purchasing power.

In recent days, Fed officials have been increasingly open to promoting that FOMC can suppress inflation only via pressing growth. This approach is helping the dollar locally.

If the Bank of England adopts this rhetoric, the pound may be able to swim against the current. But until then, a systematic sell-off in the GBPUSD from the peaks near 1.4270, reached exactly three weeks ago, is conspicuous. The cable has fallen below 1.3000, renewing 17-month lows and consolidating below the psychologically crucial circular level.

The FxPro Analyst Team