- The US economy is sliding downhill, increasing the chances of aggressive rate cuts by the Fed.

- The pound’s volatility jumped sharply ahead of Britain’s draft budget presentation.

The US dollar finally did what it was supposed to do. It fell against major global currencies amid signs of weakness in the US economy and renewed chances of an interest rate cut by the Fed. In recent days, the baseline scenario has been a cut in December and a further pause. However, the Fed’s decisions depend on data, and the statistics are not encouraging.

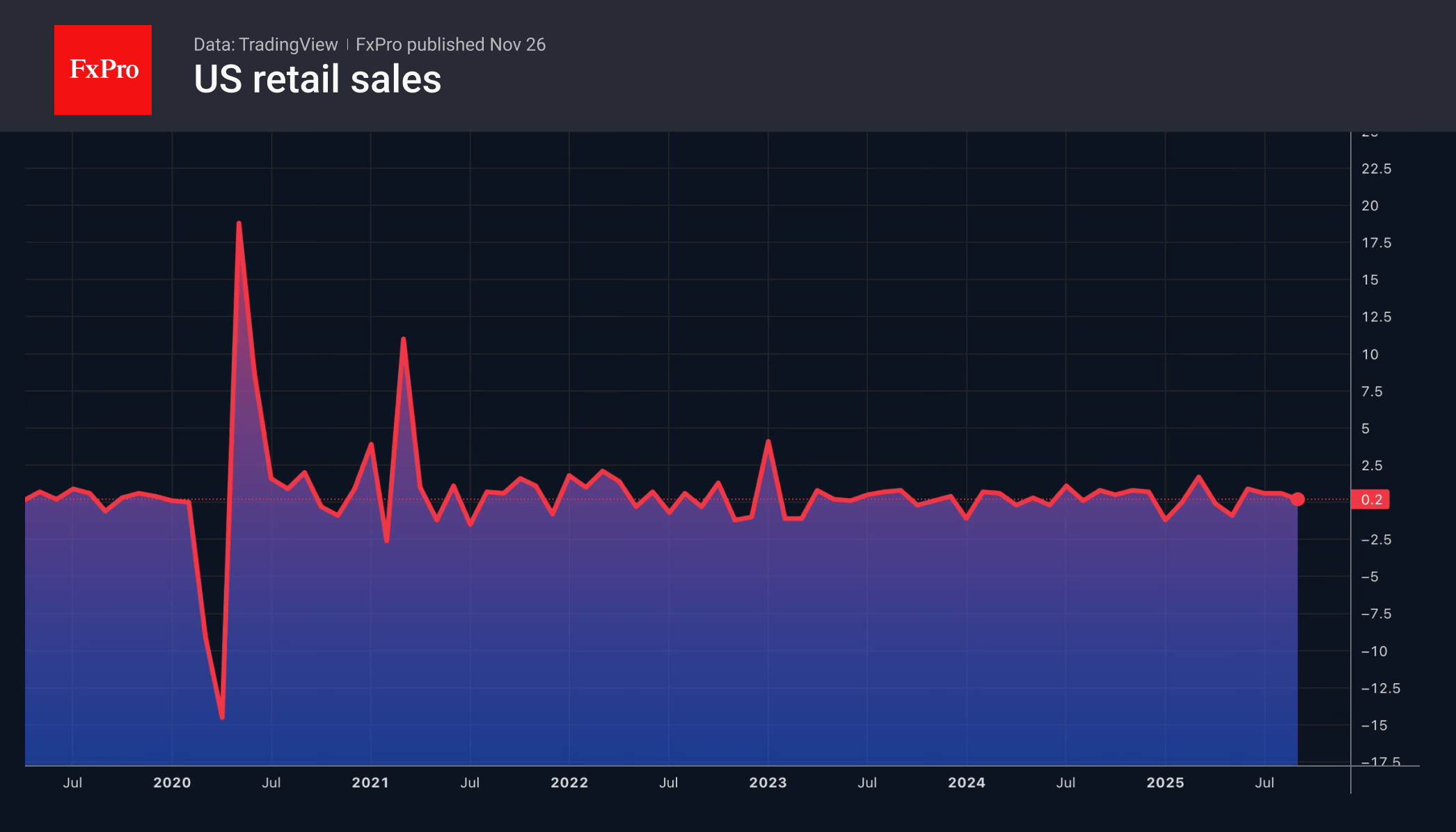

The Conference Board’s consumer confidence index fell to its lowest level since April, reflecting growing concern among Americans about the labour market and the economy. And they have reason to be concerned. ADP reported a decline in employment of 13,500, while retail sales rose 0.2% m/m in September, which is worse than analysts’ average forecasts.

Consumer fears have spread to the debt market. There, the yield on 10-year Treasuries fell below 4% for the first time in almost a month. This put pressure on the US dollar. As did rumours that Kevin Hassett could be appointed Fed chair by Christmas. A new person appointed by the president as head of the Fed will accelerate the process of lowering interest rates, which is bad news for the dollar.

The fall of the USD may be accelerated by the Supreme Court’s repeal of Donald Trump’s universal tariffs and the achievement of a peace agreement on Ukraine. These factors have not yet been fully reflected in the EURUSD quotes. According to Deutsche Bank, the euro could rise to $1.25 in 2026 as the regional currency’s share of global reserves increases.

Meanwhile, D-day has arrived for the pound. Rachel Reeves will present the draft budget, and investors are expecting fireworks. The Chancellor needs to close a £30 billion hole. How she does this will determine the behaviour of sterling and other British assets. Will history repeat itself from three years ago with Liz Truss and the collapse of GBPUSD to historic lows? Or will everything go smoothly?

Ahead of this important event, the cost of hedging EURGBP volatility has jumped to a two-year high. Investors are less concerned about the US dollar. GBPUSD volatility is at its highest since June. At the same time, the pair’s rally indicates that most of the negative news has already been priced in.

The FxPro Analyst Team