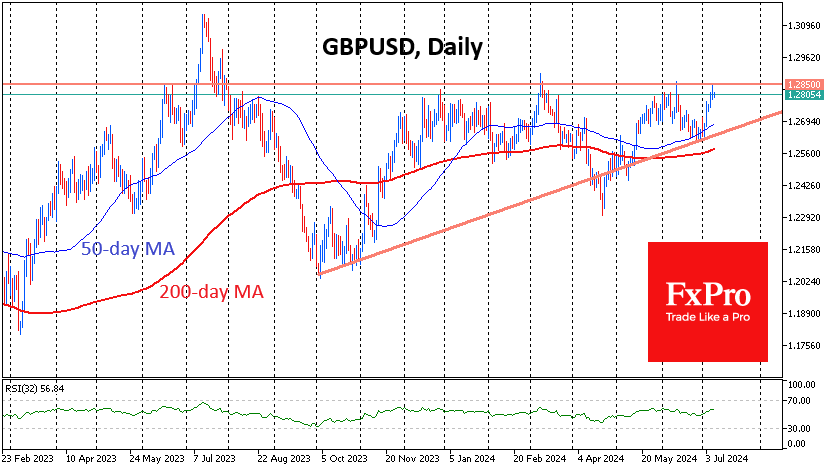

GBPUSD is trading near 1.28, which has acted as an area of resistance in the pair since last December. At the same time, the range of fluctuations of the pound is narrowing, as since October, the downside impulses have become less and less deep, with the price increasingly approaching the top of the ascending triangle. Classically, such a pattern ends with a breakout of resistance.

The current resistance’s importance is reinforced by the fact that near 1.2850 is the 200-week moving average, an important filter of the long-term trend. A failure under this line in 2022 kicked off a more than 20% collapse in the pound over the next six months. Almost exactly one year ago, we saw a false breakdown of this line followed by a month and a half of increased pressure. This only reinforces the importance of a resistance breakdown if a new bear attack does not follow it.

GBPUSD recently gained support on the decline towards the 50-week average. More importantly, the bears attempted to drag the pound back into the long-term channel in which the pair has been trading since 2008.

In the impending battle between the bulls and bears, the former has more visual advantages so far. GBPUSD’s ability to rise above 1.29 will be an important signal of a change in market sentiment, confirming the breakdown of horizontal resistance and overcoming the 200-week moving average.

The above bullish scenario opens a fast path to the 1.31 area (last year’s peak). However, the upside potential does not end here, and the pair may reach 1.42—the peak of 2021.

An alternative scenario is a new GBPUSD reversal to the downside, reversing all bullish scenarios mentioned above. This has happened many times before, and getting too excited about buying without proper confirmation signals would not be wise.

The FxPro Analyst Team