2024 has every chance of being the biggest election year, with well over half of the world’s population going to the polls. The next chapter in this saga is today, with the announcement of the results of the UK general elections.

The results were generally in line with expectations without causing significant market volatility on the publication of the first results. However, Labour coming to power after 14 years of Conservative dominance will shift priorities somewhat. It could be good news for the Pound and the outperformance of the FTSE250 over the FTSE100 due to a greater bias towards the local market.

The Tories’ main slogan, especially in the early years after the financial crisis, was austerity. Labour should be more focused on reducing income stratification through incentives for the poor and higher taxes for the rich.

Such an environment poses pro-inflation risks, which should force the Bank of England to hold the rate at a higher level than previously thought.

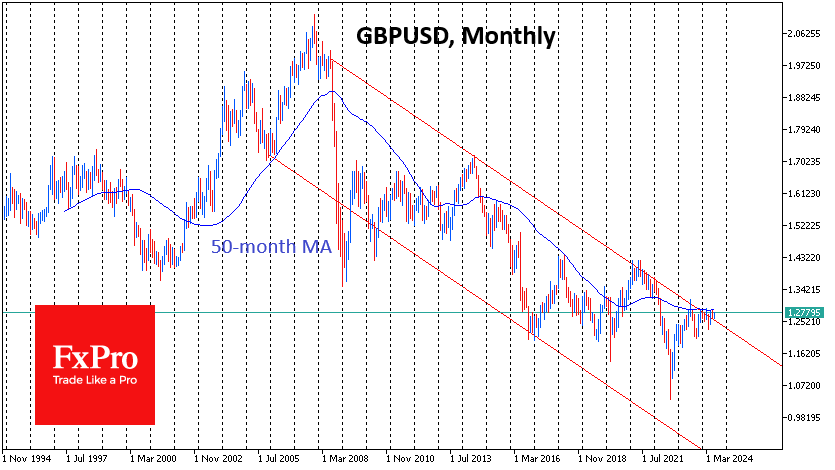

This is bullish for the Pound, which has lost over half of its value against the Dollar from its peak in 2007 to a bottom in September 2022. GBPUSD has been testing the resistance of this long-term descending channel in recent months. Changes in Britain’s domestic politics may well be a factor in favour of the bulls in this battle.

Technically, the GBPUSD bullish bias will be confirmed with consolidation above 1.2850 – the area of this year’s and last year’s highs. The pound will also have a chance to recoup most of its losses to the euro after Brexit, as a break of EURGBP support at 0.833 (1.20 on GBPEUR) could trigger a repositioning of the exchange rate to the 0.71 (1.40) area.

While the expensive pound could challenge the valuations of large global companies in the FTSE100, pro-inflationary sentiment and the expected benefits to the economy from rising expenses promise to improve the position of the FTSE250, dominated by local companies. Separate market hopes are pinned on a housing recovery with the arrival of Labour. Accelerating house price growth and a revival in sales often correlate strongly with consumer spending trends, helping to accelerate the wider economy.

The FxPro AnalystTeam