While some berated the UK government for collapsing the Pound on the government’s plans to cut taxes, others were buying the British currency. The Pound’s movement on Friday and Monday looks like a classic capitulation, often a precursor of a reversal.

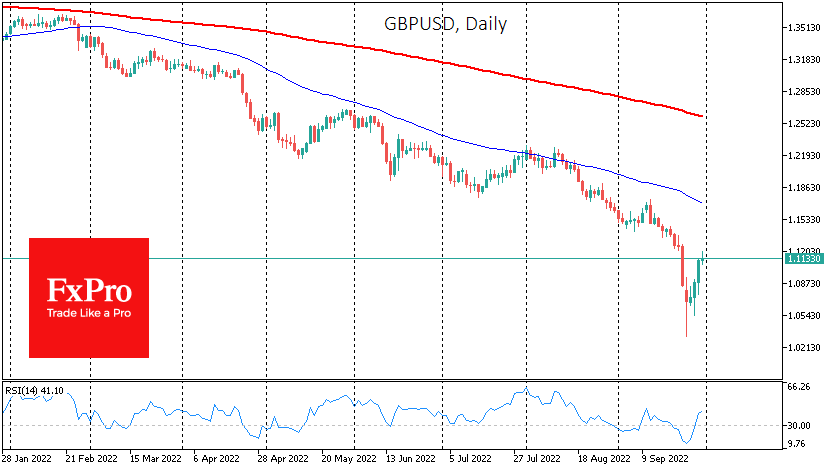

GBPUSD is adding for the third day, reaching 1.11 and nearly 7.5% above the historical low set on Monday.

Despite an extensive sell-off in the UK debt markets, the Pound has been adding. This is reminiscent of the case of the negative oil price in April 2020, after which there was no more bad news to push the price down further.

In less than a week, the Bank of England has made a complete U-turn from plans to sell assets off the balance sheet to an intention to buy them. In theory, this news should have put pressure on the Pound as it increases its market supply. In practice, stabilising the far end of the yield curve appeared to have created at least one sector in the UK market where investors could park their assets.

The US and IMF have openly criticised the UK government for plans to cut taxes and cover the short-term budget deficit through new borrowing. Interestingly, the passage of Trump’s tax reforms has been characterised, among other things, by the start of the dollar’s rise, which has added around 30% in less than five years.

It is also interesting to watch the dynamics of the Pound against the euro. Since 2016, EURGBP has been trading in a range of 0.83-0.93. The 18-month move from the upper to the lower bound through February marked a threefold faster climb. However, this touching of the upper boundary has now been followed by another (and even faster) pullback downwards.

Bank of England policy has become quite unorthodox, actively pushing up interest rates at the short end of the curve and down at the far end. The return to balance sheet asset purchases by the Bank of England is hardly justifiable as a capitulation, and we may see this dual policy intensify further. It is realistic that the Bank of England will be more active in raising the bank rate and short-term bond yields in the coming months but will continue or even intensify its buying of 20–30-year securities on the balance sheet.

Such a policy would increase the attractiveness of the Pound on money markets by making it more “competitive” against the dollar while keeping long-term credit available. At the same time, tax cuts could support interest in investing in the UK.

The FxPro Analyst Team