UK inflation statistics sparked a 0.8% rally in the pound on Wednesday morning, supporting GBPUSD gains against a general pull from risk assets.

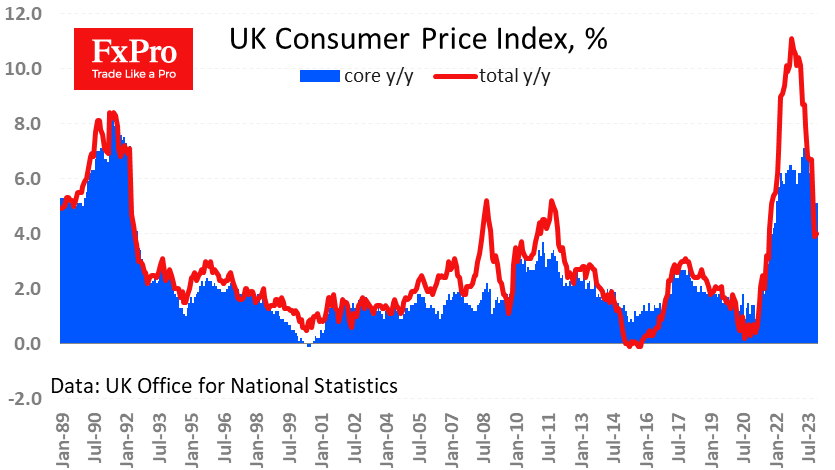

According to data released on Wednesday morning, the General Price Index rose by 0.4% for December against an expected 0.2%. Annual inflation accelerated to 4.0%, the first rise in 10 months.

The core consumer price index maintained the pace at 5.1% y/y vs. an expected slowdown to 4.9%.

The drivers of price increases were tobacco and alcohol due to one-off factors. Formally, this will make it harder for inflation to return to the target, but it is unlikely to be a factor that the Bank of England will struggle with.

In contrast, producer prices are falling more strongly than expected, and we think this is the more important factor. Producer prices fell by 1.2% after falling 0.4% previously. The year-to-date decline is 2.8% and has fluctuated between 2% and 2.9% over the six months.

Producer prices lost 0.6% over December and are up 0.1% y/y, hovering around zero for the past six months.

A separate report noted a 2.1% y/y drop in housing prices in November, weaker than the 1.9% decline expected and the 1.3% decline a month earlier.

The inflation surprise caused traders to soften expectations of a key rate cut by the Bank of England. As a result, the GBPUSD pair is enjoying gains while the markets continue the risk-aversion bias. The news also added pressure on the UK equity market, where the FTSE100 lost around 1.3%, back to early December levels at 7460.

Looking ahead, we note the decline in annualised inflation in producer input prices and disinflation in producer output prices. The slowdown in wage growth also points to a reduction in domestic inflationary pressures. Technically, this opens the door for the Bank of England to start easing policy, but we should expect the central bank to take this step only after signs of a significant cooling of the economy.

Technically, GBPUSD got support on touching the 50-day moving average. But yesterday’s decline has already effectively broken the upward trend, which has been in force since October. The pound may stabilise for a while in the 1.26-1.27 range, but there are still higher chances that the exit from consolidation will be down, not up.

The FxPro Analyst Team