The British pound is on the offensive, having risen to a three-month high against the dollar thanks to a developing correction in the latter, market stabilisation following the change of government and pro-inflationary news.

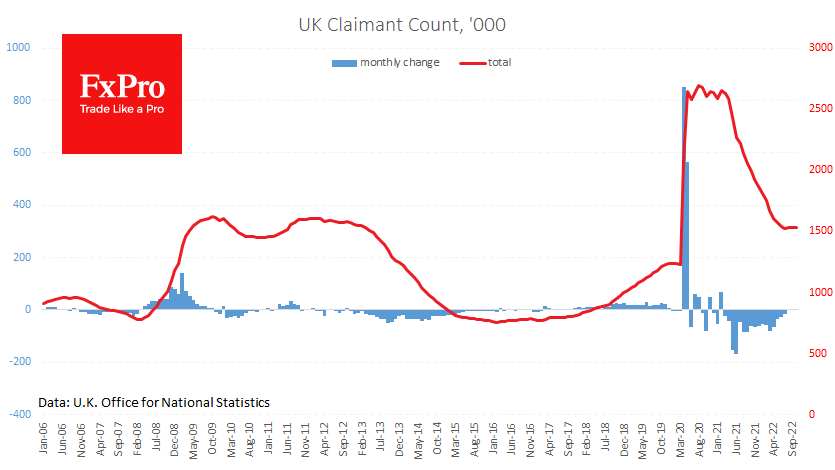

Jobless claims rose by 3.3K in October after a 3.9K increase in September. September’s data was an impressive revision from the initially reported 25.5K jump. Statistics now point to stabilisation in the number of unemployed near 1.5m – 2009-2013 levels. A month ago, the UK labour market was losing jobs rather briskly.

More positivity comes from the wage dynamics. Taking bonuses into account, they are up 6% in the three months to August, better than the 5.5% a month earlier. In addition, rumours are circulating about the Prime Minister’s intention to raise the minimum wage, which could further push wages.

A more substantial than previously estimated labour market and new signs of rising wages create more incentive for the Bank of England to raise interest rates actively.

GBPUSD surpassed 1.19 on Tuesday, adding more than 15% to the lows at 1.0330 set on September 26th. The Cable overcame a pullback of more than 38.2% of the amplitude of the decline from the highs of 2021 to the lows of September, a significant Fibonacci retracement level. Breaking this mark indicates that we see more than a corrective bounce in the Pound before a new round of decline.

However, despite the impressive size of the rally of the last almost two months, the Pound still has the potential to rally further due to the extreme previous oversold condition. The nearest local bullish target looks to be the 1.2200 area, where the pair received support on declines in 2016, 2019 and 2020.

There are chances that this area will now turn into an equally significant resistance. This area is also close to the 50% mark of the decline, a move above which could clear the way further up.

The FxPro Analyst Team