The European Central Bank has kept its key rate unchanged and officially announced that it will stop buying as part of its asset purchase programme from July 1. In an accompanying commentary, the ECB explicitly indicated that it intends to raise the rate by 25 points at its next meeting, depriving the markets of intrigue for the coming weeks.

However, the ECB also indicated that it intends to tighten policy in September and could raise the rate by 50 points.

Quite expectedly, the ECB’s stance looks much softer – dovish – compared with that of the central banks in the USA, UK, Canada, Australia, and several others that are many months ahead of the European Central Bank in their policy reversal.

Moreover, the ECB has lowered its GDP forecasts for this year and the next, from 3.7% to 2.8% in 2022 and from 2.8% to 2.1% in 2023.

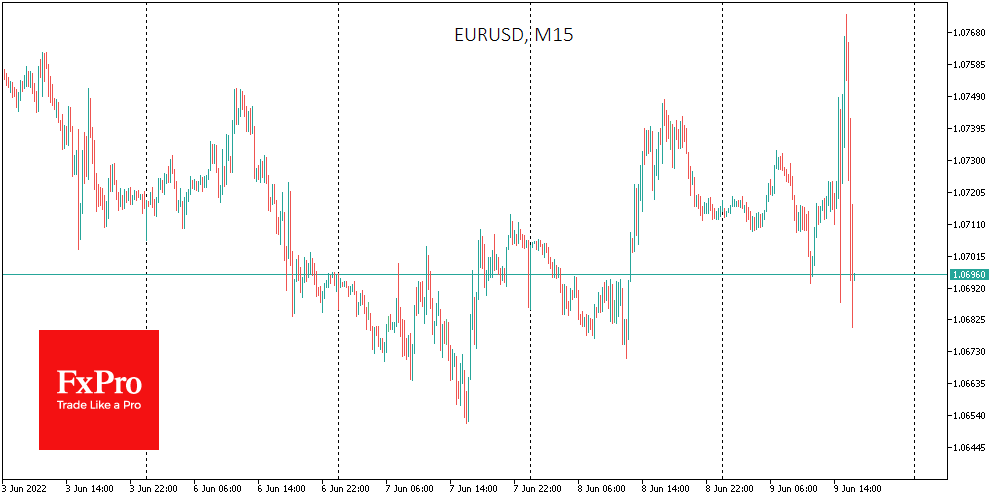

With such a clear difference in policy and worsening forecasts, it was unexpected to see a positive reaction from the single currency. In our view, this assessment by the market could reflect short-term speculative buying on the policy reversal, similar to how the Pound and Dollar strengthened before respective rate uplifts.

Nevertheless, with a comparable rate of inflation, the ECB has a lag in policy normalisation, and this gap promises only to widen in the coming months. This is terrible news for the single currency, so we should not be surprised if we continue to see the euro selling off on intraday growth attempts.

The FxPro Analyst Team