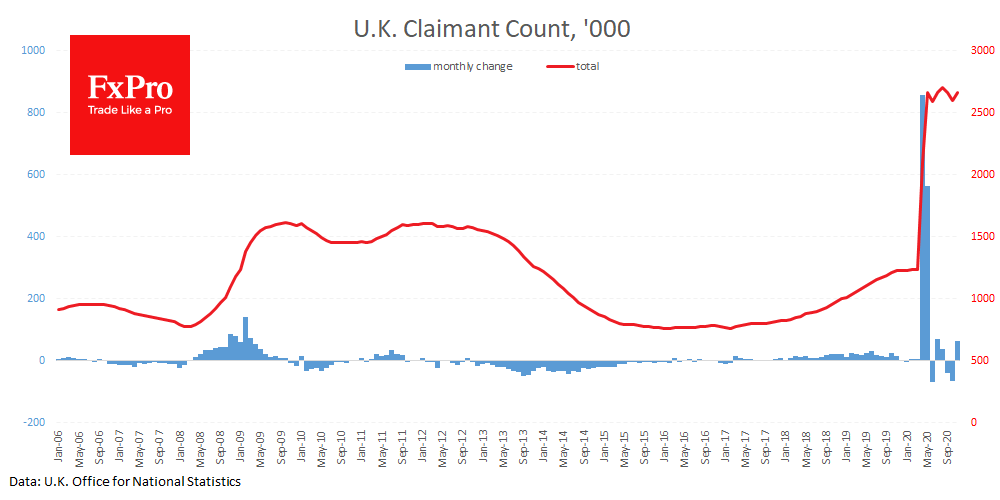

The UK’s Office for National Statistics published rather worrying labour market data earlier today with a jump in Claimant Count by 64.3K, more than reversing the decline from a month earlier (-64.1K). In terms of employment numbers in the UK, it is too early to declare the start of a labour market recovery, as the total Claimant Count is hovering near peaks. Separate flash estimates from the ONS show a fall in employment by 28K in November.

In the three months to October, total payrolls rose 2.7% compared to the same period a year earlier, markedly better than the 1.4% in the previous month and forecasts of 2.2%. Wage growth is a good signal in times near full employment; when jobs are in decline it is a sign that companies are “optimising their workforce” by cutting the lower-paid employees.

In addition to the coronavirus, a long drawn out Brexit is weighing on Britain, undermining prospects for recovery. In this environment, it would not be surprising if GBP will underperform compared to its counterparts in the near term.

The FxPro Analyst Team