The New Zealand dollar is up more than 1% against the US dollar on Wednesday, breaking above 0.6000. A rebound in global markets and better-than-expected local data support the rise.

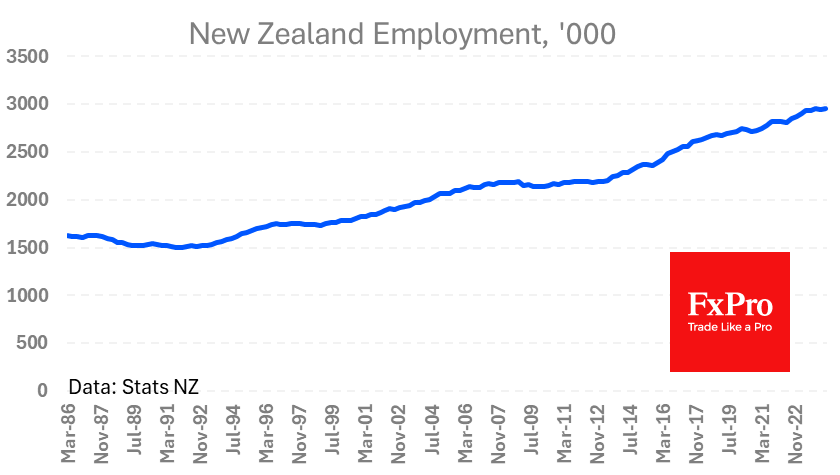

The unemployment rate increased to 4.6% from 4.4% in the second quarter, but most experts had expected a rise to 4.7%. The share of the population in work rose to 71.7% instead of falling as expected. The climb in the unemployment rate is because more people are looking for work. However, the number of employed has increased by 0.9% y/y. Private sector wages have risen 0.9% in the last three months and 4.2% y/y.

The new data makes it less likely that the key rate will be cut from 5.5%, the highest it has been in 16 years.

The NZD/USD pair has been rising since the beginning of the month. It has formed a fourth reversal from an important support level that has been in place since October 2022. The pair has also been oversold since the second half of July, strengthening today’s short squeeze.

However, we can talk about a global reversal in NZDUSD only after it exceeds the earlier high of 0.6150. A rise to this level will also break the consolidation pattern the pair has been forming since last year. If it rises another 2% from current levels, sellers may resist.

The FxPro Analyst Team