- The Fed may resume asset purchases.

- Carry traders are selling the US dollar.

- The chances of a BoE rate cut are increasing.

- Japan is not yet ready for intervention.

A deterioration in global risk appetite and rumours of the Fed resuming asset purchases have pushed the US dollar to its lowest levels since late October. It is noteworthy that the greenback was not helped by hawkish comments from FOMC officials and a reduction in the chances of a federal funds rate cut in December to less than 50%. However, they seriously damaged the stock and crypto markets.

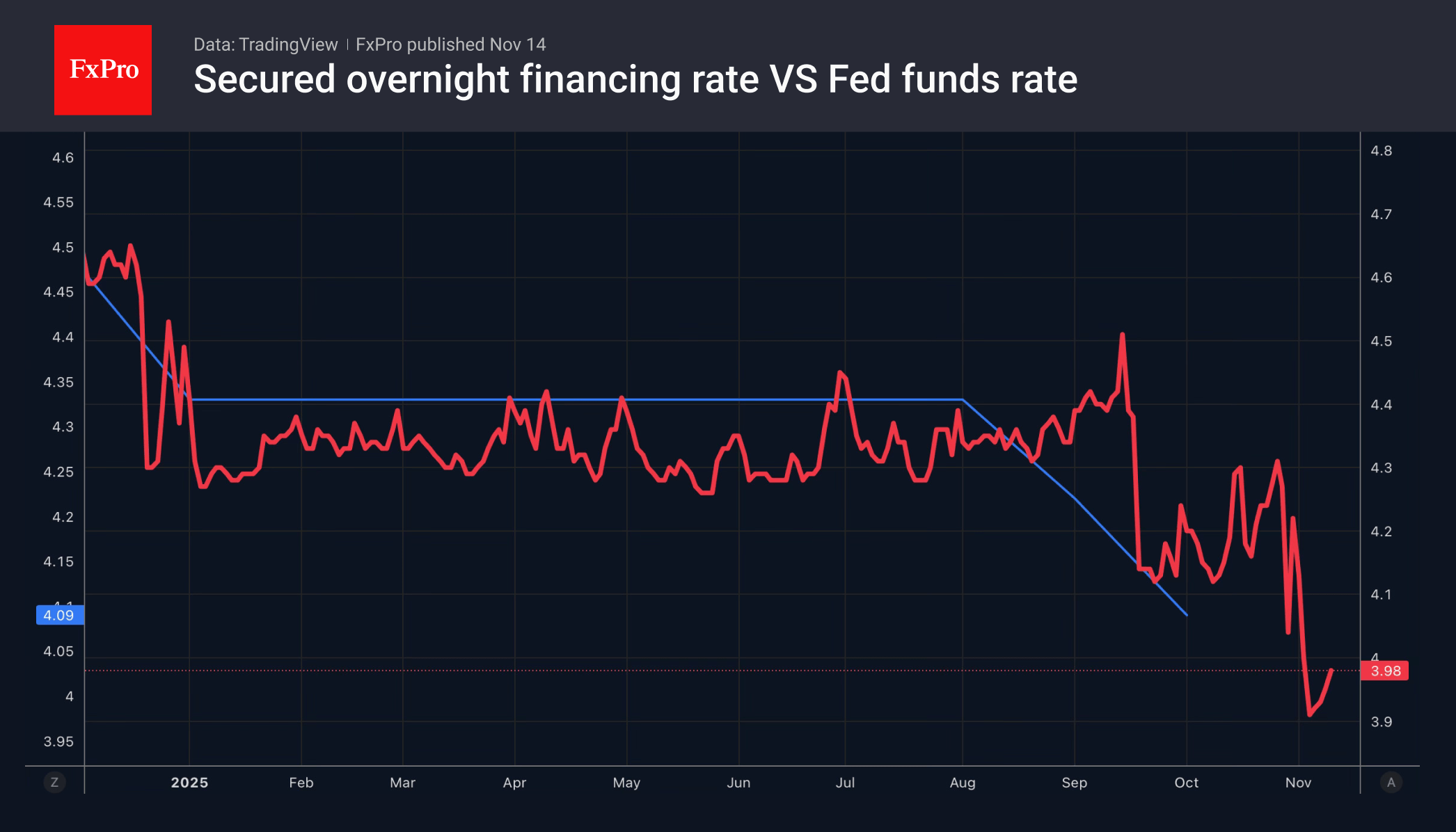

The increase in the volume of Treasury bill issuance, the shutdown and the reduction in the Fed’s balance sheet have drained money from the US banking system. The lack of liquidity is leading to higher interest rates for lending. To alleviate the symptoms, the central bank should resume asset purchases. Acting prematurely, speculators are driving down Treasury yields, which is negative for the dollar.

The greenback is being actively sold as part of the unwinding of carry trades. Low volatility and high rates have made it an attractive currency for income. At the same time, profit-taking on long positions in the S&P 500 due to the implementation of the principle of ‘buy the rumour of the government opening, sell the fact’ is dampening risk appetite.

The hawkish rhetoric of FOMC members has been insufficient for the dollar lately. Cleveland’s Beth Hammack believes that the Fed should maintain stable rates to prevent inflation from rising. Alberto Musalem from St. Louis called for caution. Mary Daly from San Francisco noted that it is too early to judge the December decision.

The weakness of the US dollar allowed other currencies to overlook their vulnerabilities and launch a temporary counterattack. However, the pound came under pressure due to the upcoming tax increases and signals from the Bank of England about a reduction in the repo rate in December. The chances of such an outcome jumped from 59% to 74% after unemployment in Britain rose to 5%.

The USDJPY pair’s approach to the psychologically important 155 mark spooked buyers. As quotes rise, the risks of currency intervention increase, and speculators begin to move more cautiously, as if on a minefield. However, previous interventions by official Tokyo in the Forex market were not linked to a specific level. Governments are only concerned about excessive fluctuations, and the relative silence from politicians on this issue suggests that actual steps are still a considerable distance away.

The FxPro Analyst Team