The markets returned to caution Friday, which can be explained by the frustration with new Chinese data, but also by the caution of investors after unsuccessful attempts to develop growth in certain markets. Overall, the recovery of the economy and markets is losing momentum.

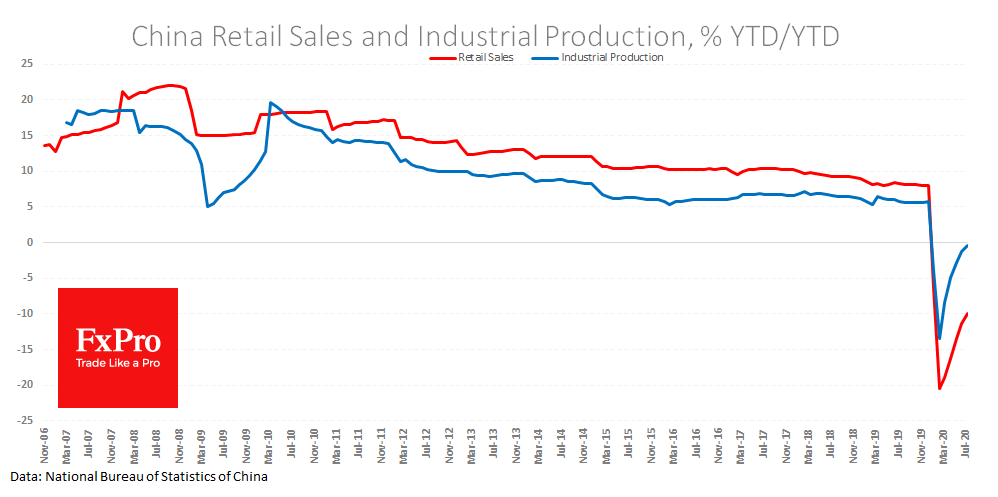

The July data on Chinese industrial production fell short of expectations, maintaining a growth rate of 4.8% YoY vs forecasted acceleration to 5.1%. Industrial production in the first seven months of this year is 0.4% lower than in the same period a year ago.

The retail trade is in worse shape, with July sales falling by 1.1% YoY. The year to date decline is 9.9% compared to the same period of 2019. This is a reflection of consumer uncertainty, which will hurt overall growth rates.

However, it is essential to understand that domestic Chinese data rarely has a lasting impact on markets. Its can easily be overshadowed by news on trade negotiations, with the next round scheduled for tomorrow. And now, some positive signals are already coming in with more relaxed mutual discussions.

Separately, it becomes more difficult for the markets to follow the trends of recent months. Earlier this week, the S&P500 index was slipping at the approach to historical highs. Before the start of trading in Europe, Futures on the index again tried to break through higher.

EURUSD faces pressure from sellers’ as it attempts to grow. Since the end of July, the pressure on the pair is becoming stronger from lower levels. Two weeks ago, the ongoing decline started near 1.1900, last week it starts below 1.1880 and yesterday from 1.1860, forming a downtrend.

However, the bears are not able to fully take the upper hand. So far, EURUSD has found support in the declines to 1.1700. Such purchases on recessions indicate that the bulls are still in charge and take their time before launching a new assault.

We will only know which side will win the battle, once EURUSD breaks outside the range of 1.1700-1.1900.

The FxPro Analyst Team