- The Fed is in no hurry to cut rates, and Hassett is unlikely to accelerate the Fed’s cycle.

- The yen is concerned about the carry trade, while the ECB breathed a sigh of relief.

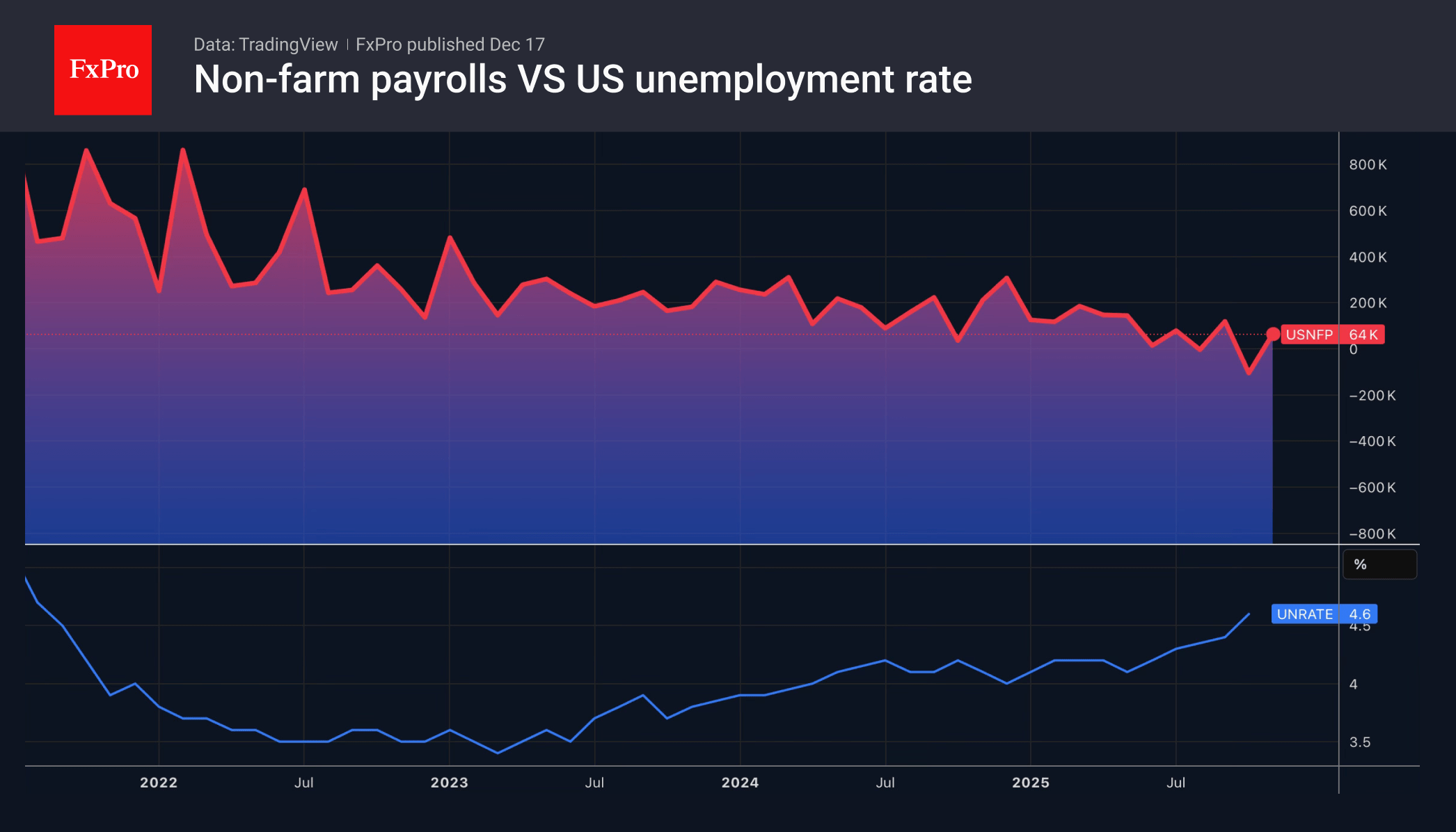

The rise in unemployment to its highest level since September 2021, along with the decline in non-farm employment in the US in October, did not alter the views of the futures market. Derivatives estimate the chances of a cut in the federal funds rate in January at 24% and in March at 52%. This is exactly the same as before the BLS report. The Fed will not resume its cycle of monetary policy easing until at least spring. Awareness of this fact sent the USD index on a rollercoaster ride.

Investors view the Fed’s monetary expansion in September, October and December as preventive measures. Their goal is to slow down the cooling of the US labour market. And we must admit that this approach has achieved its goal. While non-farm payrolls grew by an average of 13,000 per month in the summer, in the autumn, adjusted for the delayed effect of federal employee layoffs, they grew by 75,000.

The pause in the Fed’s monetary policy easing cycle plays into the hands of the US dollar. Moreover, Kevin Hassett’s appointment as Fed chairman is unlikely to accelerate the process of lowering rates. According to him, decisions in the FOMC are made collegially. Therefore, even if the president asks and the head of the central bank agrees, the cost of borrowing will not necessarily fall. Such rhetoric from the leading candidate limits the potential for monetary expansion in 2026 to one or two acts and supports the USD index.

The strengthening of the US dollar allowed the USDJPY to rebound from its local low. All 50 experts surveyed by Bloomberg predict an increase in the overnight rate from 0.5% to 0.75% at the Bank of Japan meeting on 19 December. At the same time, almost two out of three respondents expect normalisation once every six months, while 20% believe it will occur once a year. Only 2% believe in quarterly terms. The BoJ’s sluggishness, coupled with the Fed’s pause, could put the yen in a vulnerable position. Carry traders will sell it as a funding currency.

The ECB, on the other hand, breathed a sigh of relief as it watched the EURUSD react to the US employment report. The strengthening of the euro risks slowing inflation and putting a damper on exports and the eurozone economy. Disappointing business activity statistics indicate that the currency bloc still has many problems.

The FxPro Analyst Team