Chinese markets are adding 2-3% on Monday morning after reports that the People’s Bank of China will expand medium-term lending for the financial system. The promise of capital feeds the growth of Chinese markets. For Europe and the US, this news neutralizes negative factors, with futures on indices changing little after a slight decline on Friday.

Among the negative factors is the indefinite cancellation of the US and Chinese trade negotiations. The last-minute abandonment may be a signal of continuing deep disagreements. However, from the market’s perspective, ”no news is good news.”

The report about the loans against the rejection of trade negotiations directs the world into a phase of the struggle for stimulus. The victory will be not only the country with the most effective one but also the one with more opportunities to support growth.

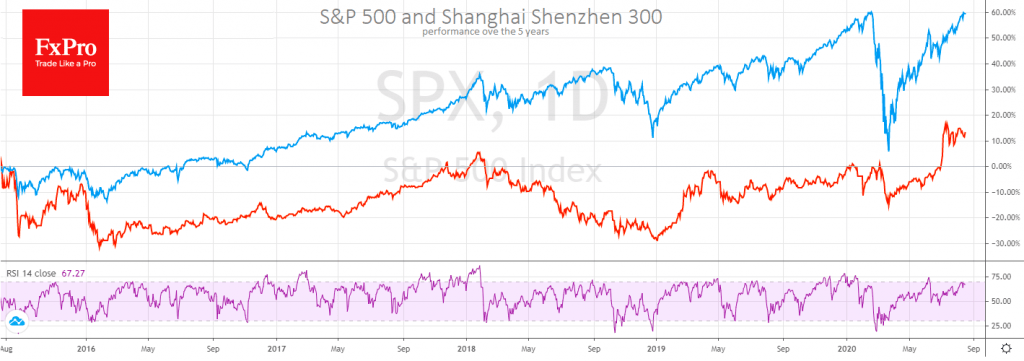

China and the US have progressed in different ways, supporting the strongest sectors of their economies, and achieving some success in this.

For China, it is industrial production, while domestic demand has not been able to become a driver of economic growth. This seems to explain why industry production is already adding 4.8% YoY, while retail sales are losing 0.1% YoY and 9.9% YTD/YTD.

The US is committed to maintaining household activity, focusing on supporting income levels. During the crisis months, income even increased. As a result, Friday’s statistics marked new highs in US retail sales and 2.6% YoY, while production decreased by 8.2% YoY. US sales year to date are 2.5% lower than for the same period a year ago.

On the Chinese side are impressive international reserves and a dynamic economy with competitive exports. Exports are also the Achilles’ heel now that the world economy is bustling with a pandemic. China is likely to continue to act as the United States did almost a century ago, unprecedentedly expanding government expenditures on infrastructure and working to find orders outside of the country.

The United States has high confidence in the dollar in the world financial system, having attractive fundraising rates. But there are growing fears that the US has passed the point of maximum efficiency of government stimulus and is in dangerous proximity to the point of investors demanding a higher premium on loans in dollars.

The FxPro Analyst Team