As expected, the US Federal Reserve cut its key interest rate by a quarter of a percentage point to 4.50-4.75%. The decision did not cause a strong market reaction, allowing the major indices to renew the previous day’s all-time highs. However, this move did not find support, as we saw slippage in early trading on Friday.

Market attention is shifting to plans for next year. Powell has indicated that we should first see measures to cut taxes and strengthen economic growth, which is the same mindset for now.

It is worth noting that the market has been moving smoothly towards expectations of higher rates. The probability of the key rate remaining at its current level in December is around 32%, compared with 13% a month ago and 17% a week ago.

According to the pricing of interest rate futures, the most likely scenario is a 75-basis-point decline to 3.75%-4.00% by next November. A month ago, the market priced 125 points cut to 3.25-3.50%, which was the most likely scenario.

This is a positive development for the dollar as it suggests that dollar assets are more attractive. Some observers are predicting a sharp tightening by the Fed in response to Republican election plans, including import tariffs and tax cuts. So far, these are risks that create the potential for further dollar strength.

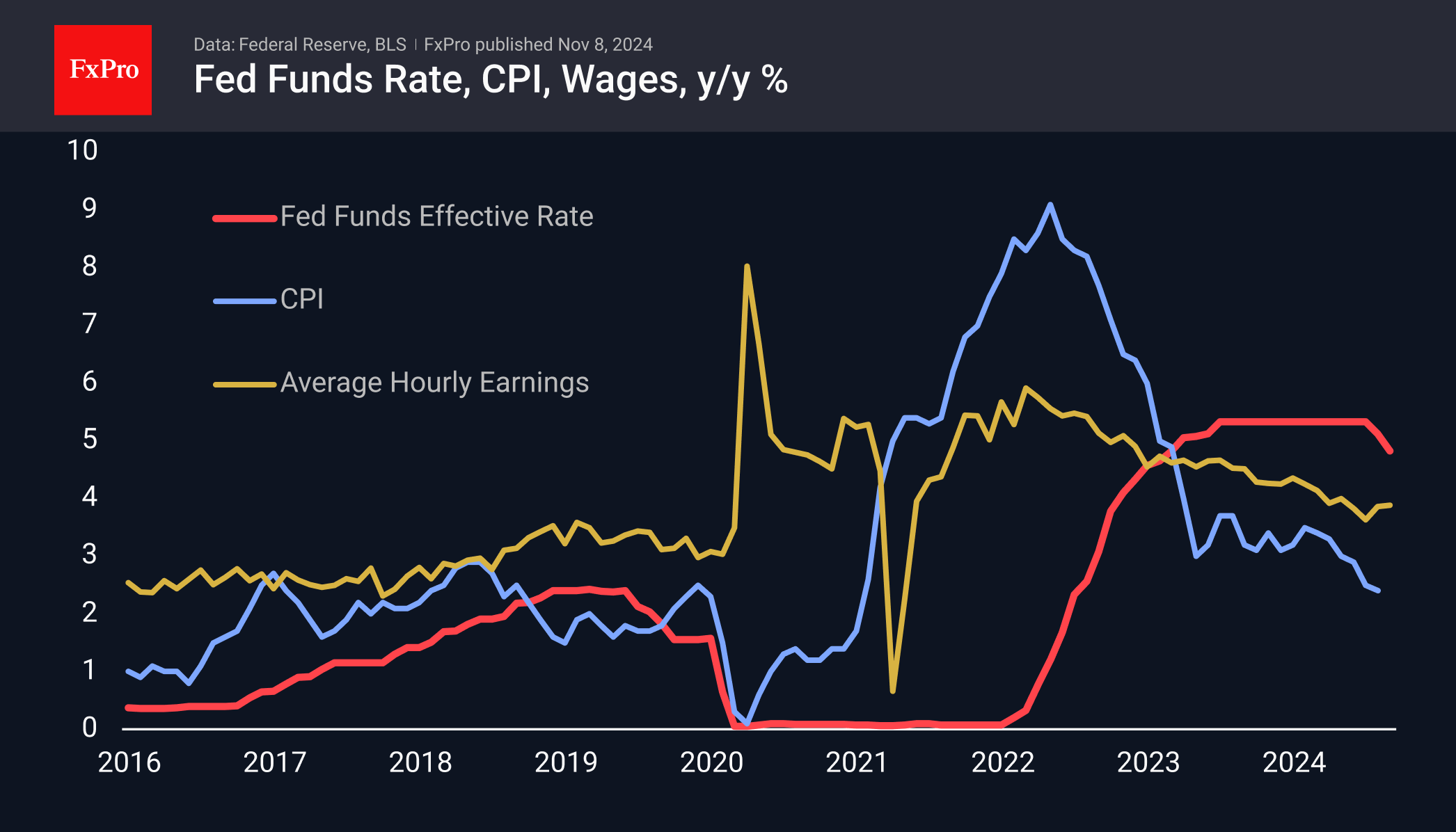

Another important factor influencing interest rate expectations is consumer inflation. Next Wednesday’s report will allow us to assess whether inflation has maintained its downward trend despite wage growth of almost 4% year-on-year. Friday’s retail sales report will complete the picture—an important test of the strength of consumer demand: Has last month’s weak employment report affected consumers’ willingness to spend?

The FxPro Analyst Team