Economic data from the US in recent weeks has reduced the risk of recession and encouraged the purchase of risk assets, but the construction sector is bucking the trend.

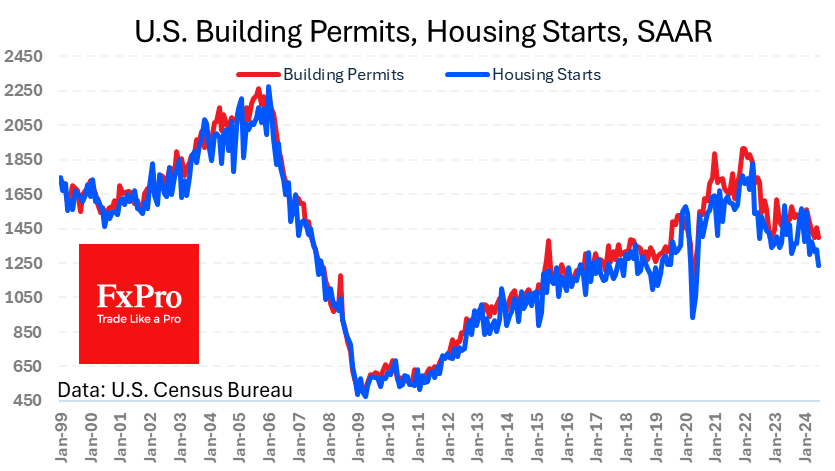

Building permits fell 4% in July to 1.396 million, the lowest level since July 2019, excluding the dip at the start of the pandemic. Housing starts fell even faster in July, dropping 6% from the previous month to 1.24 million, also the same level as five years ago.

Five years ago, the Fed cut interest rates three times—in July, September, and October—to combat the economy’s cyclical slowdown. At that time, the rate cuts were accompanied by a strengthening dollar and weeks of weakness in the S&P500 early in the cycle.

Similarly, the Fed cut rates in 2007 when housing permits and new mortgages were also falling to lower levels than they are now.

If the housing market again acts as a leading indicator of the US business cycle, as it did in 2007 and again in late 2018, the start of a cycle of policy easing in response to economic weakness will support bears in equity and commodity markets and help the dollar recover from multi-month lows. The opposite scenario, with the dollar weakening for several months after the start of the policy easing cycle, was seen in 2007. However, markets and policymakers seem to have drawn the conclusion that the longer the gap between economic cycles, the more brutal the “synchronisation” will be.

The FxPro Analyst Team